Clean Tech Boom and Bust: Will History Repeat Itself?

Last time we examined what happens during the ups and downs of the software industry. We found that the average transaction size dropped 50-70% and average valuation dropped 30-90% from peak to trough with some noticeable variability between M&A and VC and time period. This week, we explore a similar analysis, but a bit closer to home in etech.

After the dot com bubble, clean tech followed suit.

The clean tech industry has drawn more than a few parallels to the software industry, as history can speak. Investors viewed clean tech in the early 2000s much the same way as they did software in the 90s: huge markets, large potential for technology-driven transformation, and high growth opportunities. Money poured into funding this new space – a collective $2.3B went into clean tech between 2001 and 2005. By 2007, that number had more than tripled. Federal funding also ramped in earnest, numbering in the double digit billions.

2008 was the first stumbling point. The Great Recession drove down the price of natural gas, which aggressively outcompeted renewable power generation. New capital stalled while old capital began examining their existing investments. China had very quickly ramped up its solar panel manufacturing capabilities and were driving prices down below where most US manufacturers could handle. Private investment in clean tech shrunk in 2009 but then recovered in 2010 on the back of additional government investment (in the order of $100 billion). Unfortunately, that couldn’t and didn’t save existing investments and the clean tech bubble popped in full in 2012. The fiery public implosion of cylindrical solar cell manufacturer Solyndra marked the occasion.

The data shows mostly similar patterns but some key differences

The clean tech rise and fall holds many narrative similarities to that of the dot com era, filled with the classic irrational exuberance that MBA case studies will highlight for years to come. A look at the numbers both illustrates the parallels with more specificity and highlights key nuances that distinguish the clean tech industry.

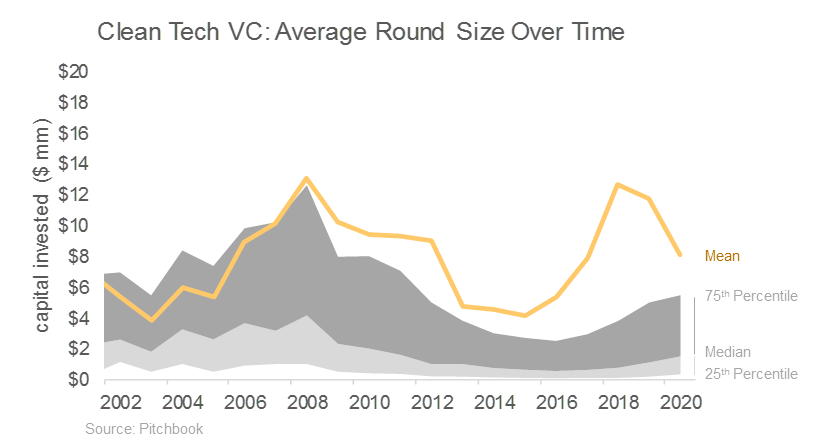

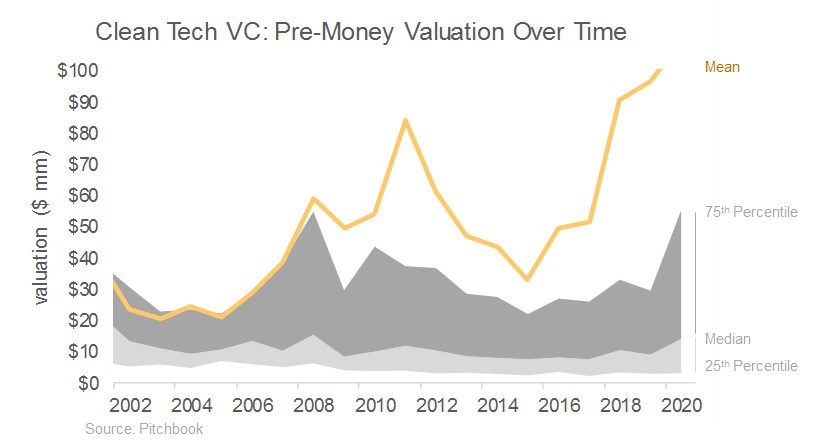

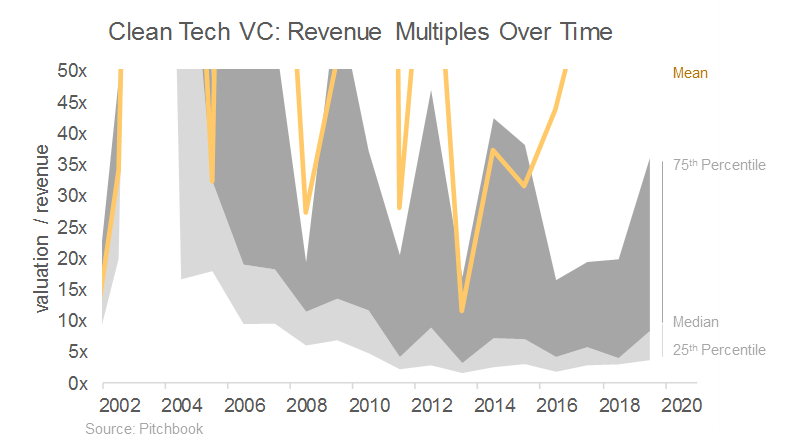

Figures 1 – 3 show average round size, pre-money valuation, and revenue multiples over time for venture capital in the clean tech industry. Like the software industry, venture capital funding dropped significantly in both average investment size and valuation post-collapse. VC round size in clean tech fell ~80% between 2008 and 2014 while average pre-money valuation fell nearly 50%. Revenue multiples fell almost 80% between 2008 and 2013.

But the shape of these collapses gives us our first clue as to what is different in the world of clean tech. While the software industry rose swiftly and fell swiftly, peaking in 2000 and bottoming in 2002, the clean tech industry experienced an elongated cycle, peaking in 2008 and bottoming in 2013-2015. The more gradual collapse is likely associated with the larger government intervention. Federal subsidies in the 2008-2011 time period served as a prop-up for new funding despite the already deflating growth prospects, keeping companies with unsustainable businesses alive for longer. The software industry, on the other hand, had none of this. What needed cleansing was cleansed, resulting in a steeper cliff but faster recovery afterwards.

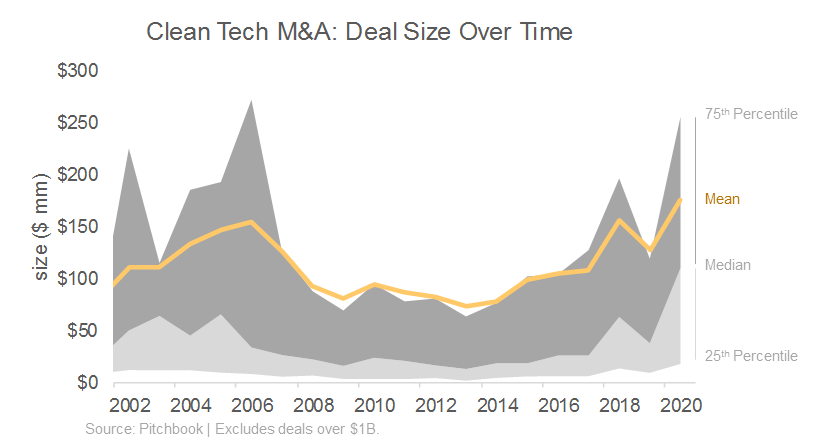

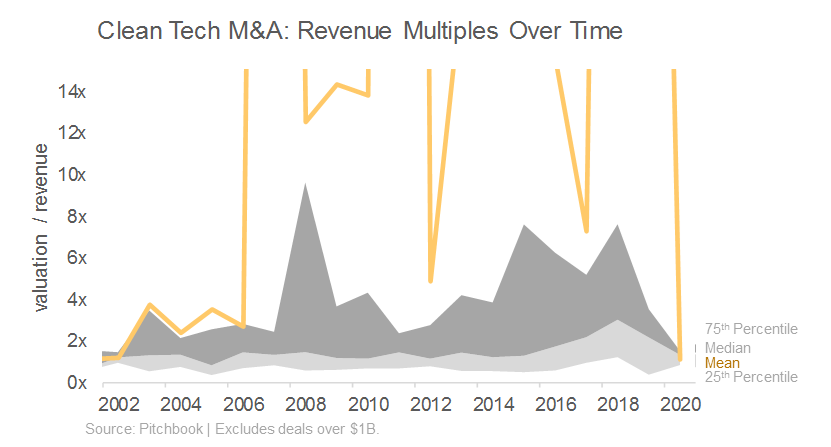

The story was even more different on the M&A side. Figures 4 and 5 show deal size and revenue multiples over time for clean tech M&A deals. Though Figure 4 shows a similar reduction in the capital pool happening for clean tech M&A, the scale is modest compared to clean tech and software VC. Deal size drops ~28% between 2008 and 2013 (vs 70 - 80% for software and clean tech VC). It actually also peaked overall in 2005 instead of in 2008 – 2010. Even more anti-climatically, Figure 5’s revenue multiples actually stay flat between 2008 and 2013.

So what is happening here? The M&A and VC transactions look like they’re in different universes because they are. While early stage clean tech opportunities were funded by the VC community, who were in large part converted software investors used to paying high growth multiples, clean tech exits were mostly limited to large energy strategics, like the power and utilities sector for power gen companies, who typically made staid, conservative offers. The differences in approach are starker than those between a software startup and a larger software company. Not having accounted for this change in exit optionality, VC valuations were inflated, contributing to the bubble.

Clean tech won’t make the same mistakes again…hopefully

Clean tech has since recovered from 2012, with annual VC dollars invested reaching its highest ever in 2018 at $14.8 billion. While it’s true that there always will be more cycles to come, the lessons learned from the first bubble have hopefully allowed investors to play smarter and more sustainably in current and subsequent periods of change. Better understanding the need for longer development times for equipment-heavy technology, the value of engineering and manufacturing expertise, and what are realistic returns / exit options will increasingly breed a new type of VC investor, one that is tuned to best capitalize on clean tech. Coupled with the diminishing government subsidies for renewables, we should see a cycle for clean tech that looks more like that of the software industry this time around: unmerciful but quick to bounce back.