A few weeks ago, I had the honor of presenting to Golden Seeds, one of the largest angel groups in the US (and arguably the largest focused on investing in women-led businesses), on climate tech.

I was struggling a bit with figuring out a topic until I started thinking about the role of angel investing in climate tech.

In normal angel investing, angels come in as gap fillers - bridging (figuratively but sometimes literally) friends and family money and VC capital. Traditional angel investing prep founders for the first institutional VC round, which means angel investors primarily look for investments that are VC-worthy. A quick search for angel investing how-to's (AngelList's resource center, SeedInvest's Angel Investing 101, FasterCapital's Comprehensive Guide to Angel Investing) reveals that angel investing is pretty much synonymous with investing in early stage startups and is often discussed in the context of venture capital.

In climate tech, this paradigm doesn't work quite as well. Many businesses are what I would call non-venture models. These include "developer" businesses and new service providers...some examples in the presentation below. These businesses have different, often slower growth trajectories but can get to cash flow quicker. They also don't necessarily need a VC in the next round.

When it comes to angel investing in climate tech, I wondered if there were more creative ways in which angels could make an impact outside of copying the same model as in traditional angel investing. My three suggestions:

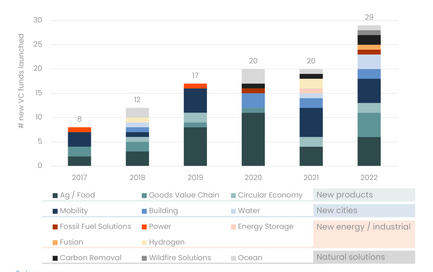

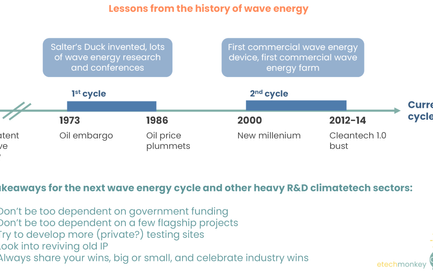

- Invest more in climate tech and invest intentionally in underrepresented technologies - as shown in data from the Angel Capital Association, there is still room to allocate more capital to climate tech from the overall pool of angel capital available. And within climate tech angel investing, capital tends to stay away from industrial and energy, sectors that, on an emissions basis, have a disproportionally larger impact than others. So angels can think about investing more intentionally into areas that have bigger emissions impacts.

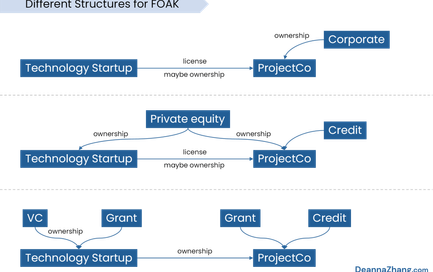

- Be open to funding early stage non-venture models using a "micro-private equity" mindset, examining time to cash flow, collateralization, and using more structured convertible debt - this is one that is probably hardest to give a good recommendation on because these growth models are still being developed. But for early stage businesses in climate tech that aren't traditional venture models and don't have "unicorn" potential, perhaps there's some form of micro-private equity angel investing that can fill a gap between non-cash flow and cash flow stages of a business. These businesses may still not be able to access traditional small business lending but still have a need to fund operations for a small business model. So is there a way for angels to write creative paper, like tranched convertible debt with a tailed coupon and some collateralization, in order to fund these businesses?

- Be carbon champions in the community by early adopting new consumer-facing technologies - finally, angels also tend to be relatively wealthy & impact-oriented individuals compared to the general population. Like how the early buyers of higher-end Tesla models eventually supported the mass commercialization of the business, can angels become early adopters of certain technologies in order to support their commercialization into the mainstream?

As I prefaced while delivering this live, I am new to angel investing myself so would love to foster more of a discussion on these suggestions vs. being overly prescriptive. Especially on #2 since it involves templating a new financial instrument.

See the presentation below. Would love feedback from and to start a discussion with any angel investors out there that are reading this!

Download

CERAWeek Reflections, FOAK Happy Hour Diagrams, and New Blog (no more Etechmonkey!)

Climate tech theme to watch: decentralization