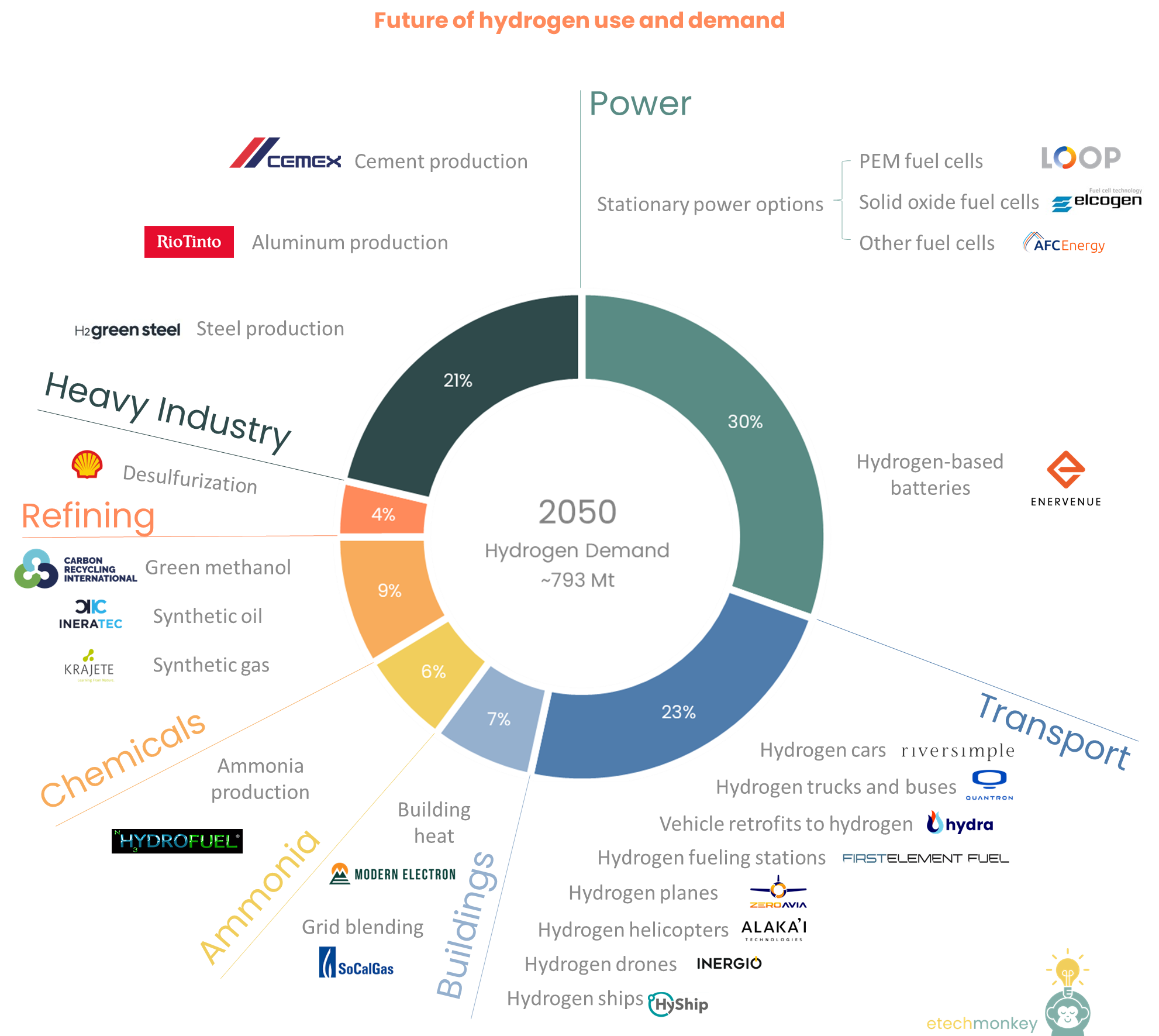

Future hydrogen uses and demand

Now having discussed hydrogen production and logistics, the last piece of the puzzle is….hydrogen uses and demand!

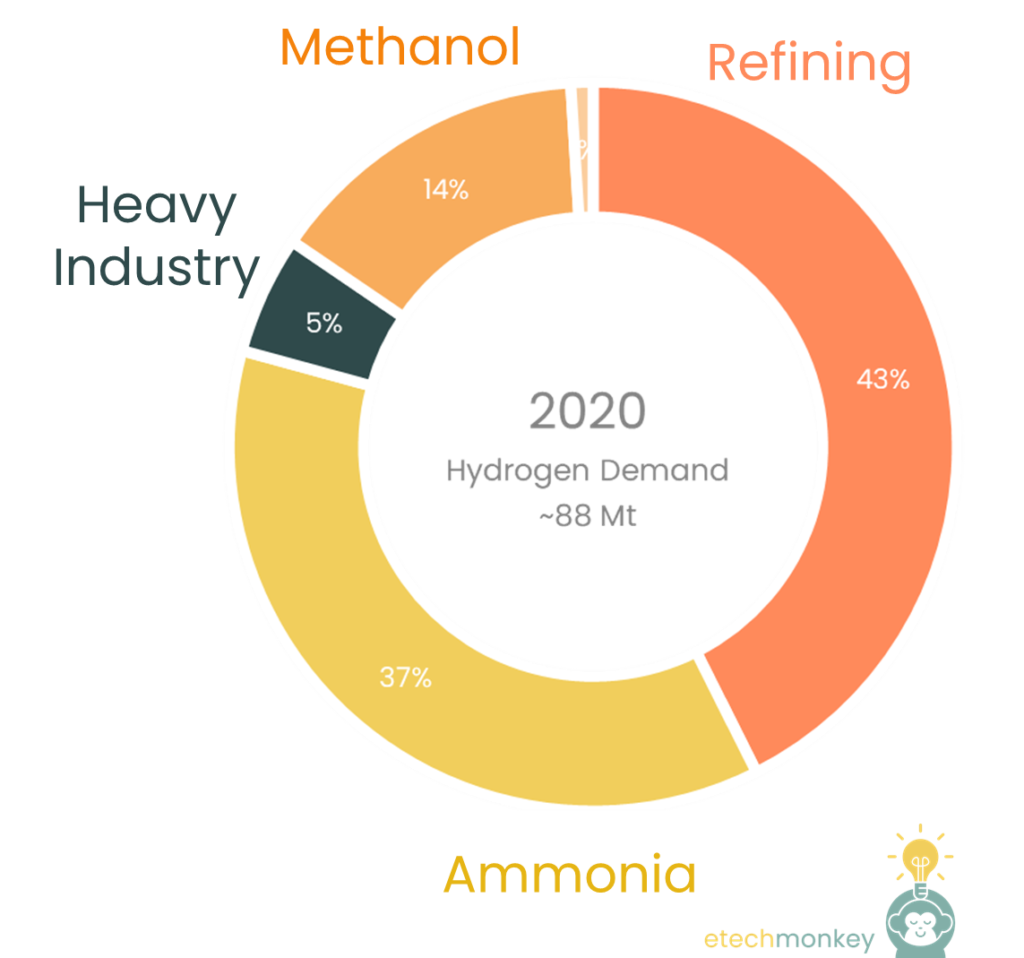

Right now the hydrogen use chart is dominated heavily by industrial offtake – out of the combined ~75 Mt of pure hydrogen in the market in 2020, 37Mt was used for refining, 33 Mt for ammonia production, and the remaining 5 Mt for reducing iron for steel production. Including hydrogen in syngas adds another 15-20 Mt to the total, most of which is used in methanol production.

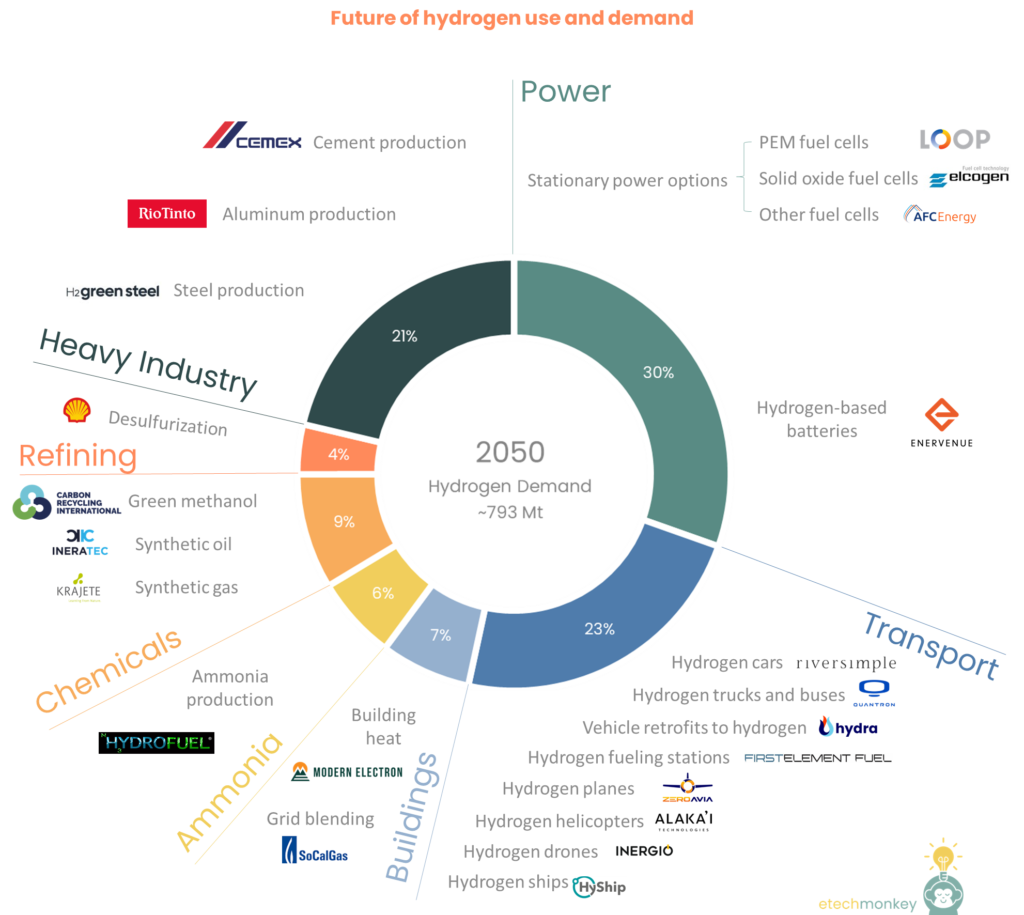

The future of the market is much more diversified…and much harder to predict. 2050 forecasts swing wildly depending on assumptions (e.g. BNEF’s Gray scenario predicts 190 Mt of hydrogen vs. 1,130 Mt in their Green scenario), but most seem to assume more than 500 Mt of hydrogen demand is necessary for a successful transition.

For simplicity purposes, I’ve averaged three sources (BNEF Green, IEA Net Zero by 2050, and Hydrogen Council’s 2050 forecast), which results in ~793 Mt of hydrogen demand. 75% of this demand comes from new uses: Power (30%), Transport (23%), and Heavy Industry (21%). The remaining quarter is made up of hydrogen offtake that largely exist in some form today (ammonia: 6%, chemicals: 9%, refining: 4%) in addition to building heat demand (7%).

(Note that these are not vetted or sorted. This is just a list I compiled of advertised hydrogen use methods from various companies):

- Power is probably the most controversial use of hydrogen because of traditional, higher efficiency storage options like batteries or hydropower. Roundtrip efficiency of storing electricity in the form of hydrogen ranges from 18-46%, compared to 60-90% of most other forms of storage. Nonetheless, intermittency remains a key issue in the deployment of renewables and in some cases (when factoring in supply chain constraints, unfavorable geography, weight limitations, charge and discharge time required, need for off grid fuel, and scalability), it may make more financial and practical sense to go with a hydrogen fuel cell system.

- Most of the innovation in this area is centered around developing and commercializing better fuel cells. Like in the electrolyzer space, there are different chemistries for fuel cells, with most companies specializing in one or two types (with some of the same companies working on both electrolyzers and fuel cells of the same type). Some of the more popular ones include solid oxide fuel cells (Elcogen) and PEM fuel cells (Loop), which are generally more commercialized at scale than their electrolysis counterparts. Lux research gives a great overview of stationary fuel cells here.

- Some hydrogen storage options don’t use fuel cells. EnerVenue, for example, is deploying nickel-hydrogen batteries for utility scale storage.

- Transport is the second largest future use of hydrogen and one that seems to have the greatest number of startups working on new solutions. Larger auto (and forklift) makers like Toyota are also eyeing hydrogen as a clean transport solution. Due to its low gravimetric energy density, hydrogen is seen as a more favorable solution for heavier vehicles – trucks and buses – and transport that is weight sensitive – shipping, aviation, and freight. Some examples of new hydrogen transport include:

- Riversimple’s Rasa, a two seater hydrogen FCEV offered on a subscription basis

- Quantron’s Q-Trucks or Q-Buses, FCEV light-duty trucks and city buses

- Hydra’s vehicle retrofits of heavy-duty trucks

- FirstElement Fuel’s TrueZero hydrogen fueling station network

- ZeroAvia’s hydrogen-fueled plane

- Alaka’i’s hydrogen helicopter-like vehicles

- Inergio’s hydrogen-powered drones

- Hyship’s liquid hydrogen-run cargo ship

- Heavy industry is the third largest source of future hydrogen demand and possibly the most impactful when considering potential for near-term emissions reduction. Concrete, steel, and aluminum contribute over 7 Gt, ~44% of which are direct heating-related. Replacing these heating sources with hydrogen fuel or a mix of hydrogen fuel with other low carbon fuels can be a way to reduce a lot of emissions in one fell swoop. An additional 32% of emissions comes from electricity for things like electric arc furnaces (steel) or smelting (aluminum), which can also be decarbonized through hydrogen-fueled stationary power. The remaining quarter of emissions are process-related. Hydrogen has the most potential to replace natural gas as a reducing agent in the steel process. So in practice:

- CEMEX has been injecting hydrogen into its fuel mix for its kilns since 2019

- H2Green Steel is combining large scale electrolyzers to produce hydrogen, hydrogen as a reducing agent for producing direct reduced iron (DRI) from iron ore, and electric arc furnaces (instead of blast furnaces) to produce green steel

- Rio Tinto along with the Australian Renewable Energy Agency (ARENA) is testing using green hydrogen to replace natural gas as a source of heat for the calcination of bauxite to alumina

- Buildings is another target for clean heating. Gas companies like SoCalGas are already testing up to 20% blend of hydrogen into the gas distribution grid (as most appliances have been designed to accommodate that amount of hydrogen already). Other companies like Modern Electron are developing new hydrogen-based heating and electric systems for buildings

- Legacy hydrogen-consuming sectors like ammonia, refining, and chemicals will also move to using green hydrogen as both a feedstock and heating source.

- Companies like Hydrofuel are commercializing green ammonia production from green hydrogen

- Refineries have long used hydrogen in desulfurizing oil and gas products, cracking large products into smaller ones, and hydrogenating new products. Shell announced that they would collocate a green hydrogen project next to their refinery in Germany in an effort to lower the CI of the fuels produced nearby

- Chemicals is probably one of the trickier sectors to decarbonize with hydrogen due to many reactions’ sensitivities to increased hydrogen blending and/or any temperature changes that occur when using a new heating source. Methanol is perhaps lower hanging fruit because of its use of existing syngas. Companies like Carbon Recycling International are replacing this syngas with recycled CO2 and green hydrogen. Other companies like Ineratec (synthetic liquid fuels) and Krajete (green methane) are producing new sustainable fuels and need green hydrogen as a feedstock.

To summarize, the future of hydrogen is massively EXCITING! It’s hard not to believe in a robust hydrogen market when faced with the different products under development today that will depend on cleaner sources of hydrogen in the future.