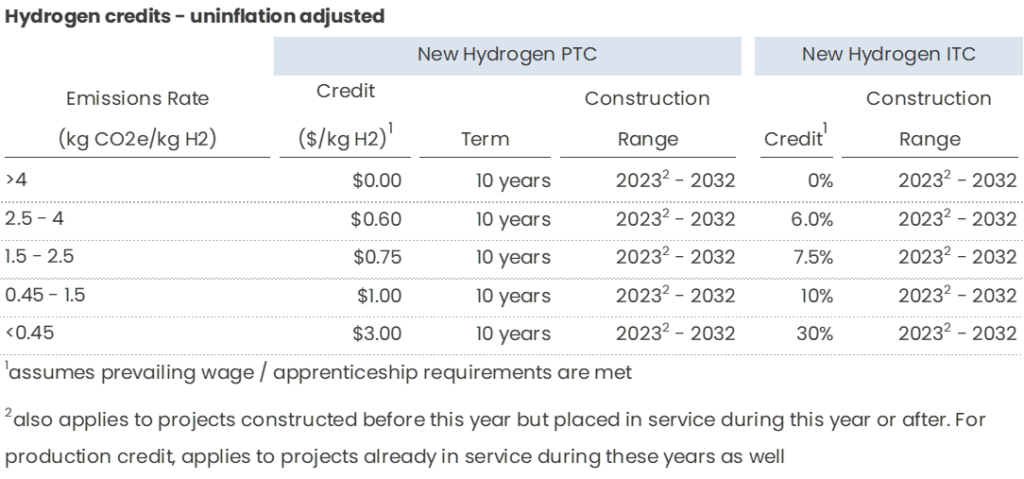

Latest beach read: the Inflation Reduction Act

Taking a break from consumer footprints this week to talk about the Inflation Reduction Act (IRA), groundbreaking legislation for the climatetech world. It was introduced last Wednesday as a substantial revamp of the Build Back Better Act (BBBA). With BBBA-opposer Senator Manchin’s support, this budget reconciliation bill opens back up the possibility of passing key climate provisions introduced back in BBBA.

I’ve taken a (painfully) close read of the bill and summarized the climate credits provisions below. There are additional sections that provide funding for government entities / agencies for specific programs that aren’t covered but that are listed out in other sources, also below.

A few observations first:

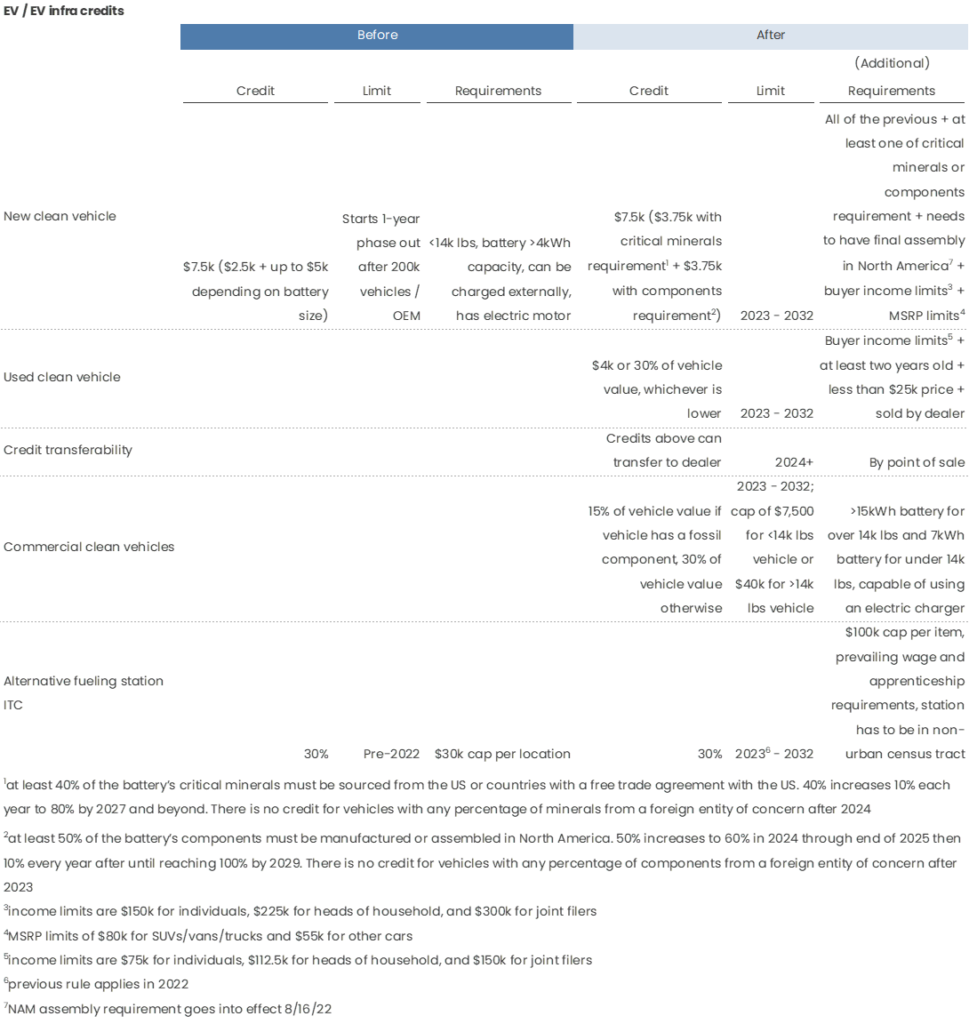

- The new EV credits seem awfully strict. To qualify for the full revised credit (which stays the same in total amount as the current credit), the cars have to be assembled in North America, be below a certain MSRP, have a major part of their battery materials and components sourced from the US or countries we don’t have a problem with (AKA not China), and be bought by individuals below a certain income. Considering many new and popular EVs like the Hyundai Ioniq 5 or Kia EV6 are assembled outside of the US, this could reduce the number of qualifying purchases pretty significantly…worryingly to the point where it slows down EV adoption.

The good news is that with the manufacturer’s cap lifted, American automakers like Tesla and Chevy will be eligible for the credit again. But with the long wait times and continued supply chain issues, it’s unclear if driving demand in that direction will result in the same amount of EV uptake as if we kept the old credit.

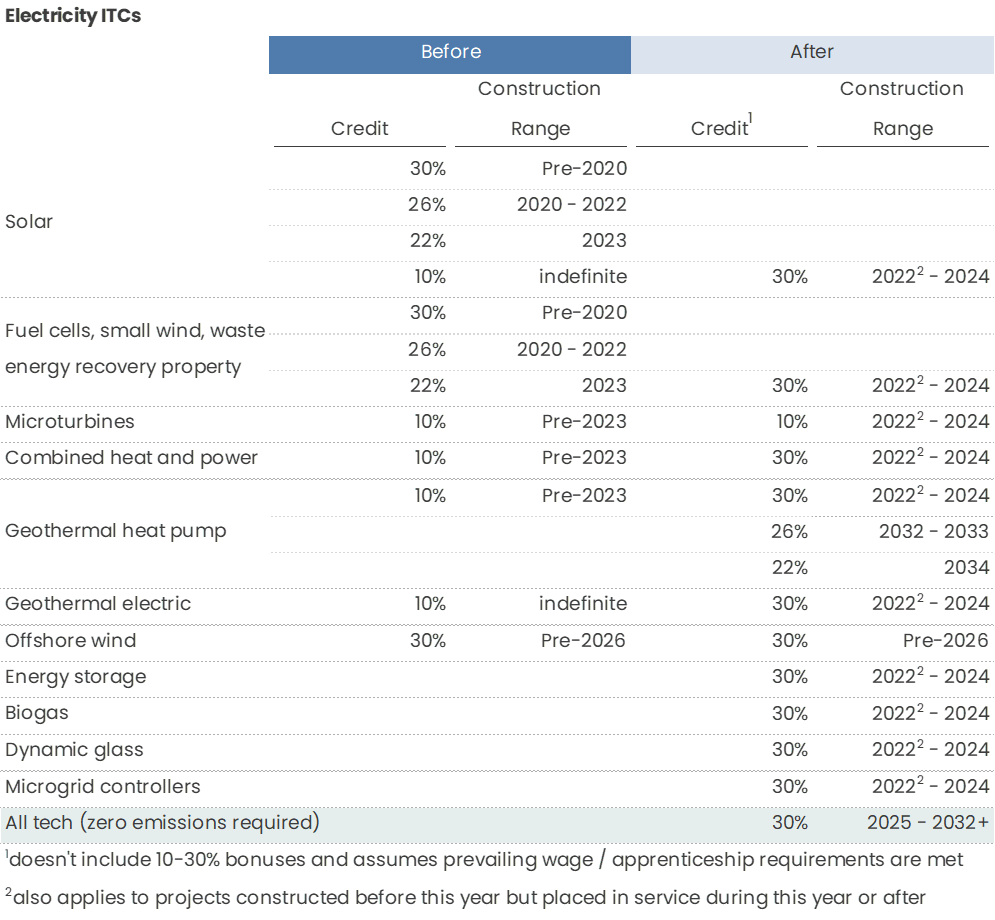

- The big winners of the bill seem to be emerging technologies, especially CCUS and hydrogen. A theme throughout the legislation was broadening the scope of existing credits to non-renewable clean technologies. The manufacturing credits, for example, includes hydrogen equipment, carbon use, recycling, and fuel cells. The electricity ITC added in dynamic glass, biogas, energy storage, and microgrid controllers. The post-2025 electricity credits make a point to be technology agnostic. There’s an underlying message being sent that we’ll need more than renewables to get to net zero – and that’s a very good incorporation by this bill.

Out of all the technologies in the bill, CCUS and hydrogen seem to benefit the most.

There’s a substantial uplift provided to the 45Q credits, near term doubling their value for non-DAC projects and quadrupling their value for DAC projects. With state incentives added in, projects should have access to anywhere from $60 – 260 worth of credits depending on their configuration. This should cross the breakeven point for most capture projects.

The hydrogen credit also is a substantial change since hydrogen production previously had no applicable credit. The potential $3/kg credit can help bring costs down substantially – even to the point of being at parity with gray hydrogen for certain blue hydrogen projects. Scaling the credit based on emissions rate instead of technology type was also nice to see as an acknowledgement that there isn’t necessarily a winning technology in hydrogen yet, despite the nearly synonymous definition of green hydrogen with electrolysis these days. An interesting bonus for the hydrogen credit is also its ability to pair with the electricity credit. Most of the other credits exclude each other…but hydrogen is one of the exceptions. With that, it’s possible for an electricity-powered hydrogen production operation to receive double the credits for one project.

The hydrogen and CCUS credits also have the benefit of qualifying for direct pay in the first 5 years of a project. Direct pay can help avoid the headache of structuring and sourcing tax equity, which can get earlier stage technologies off the ground faster by avoiding tax risk. Tax equity providers tend also to shy away from first facility projects, of which there are A LOT in the hydrogen and CCUS world. The direct pay exception will hopefully lead to slightly more derisked project economics and thus faster development. - Prepare for an infrastructure rush. It’s clear that this bill was meant to spur US manufacturing and infrastructure development, but some of the deadlines are quite tight. The electricity ITCs and PTCs without the zero emissions requirement have a construction deadline of end of 2024, which means that projects pretty much need to be FID-ed in the next 2 years. Given this, we should see a lot of early stage infrastructure projects pop up in the next 6 months if this bill is passed.

Here we go!

(Note 1: I am no lawyer and tried my best to interpret the bill given its language and the other sources mentioned below. If you notice any mismatches with your own interpretation, please give me a shout)

(Note 2: all of the following rates are NOT inflation adjusted like they should be to get the real rate.)

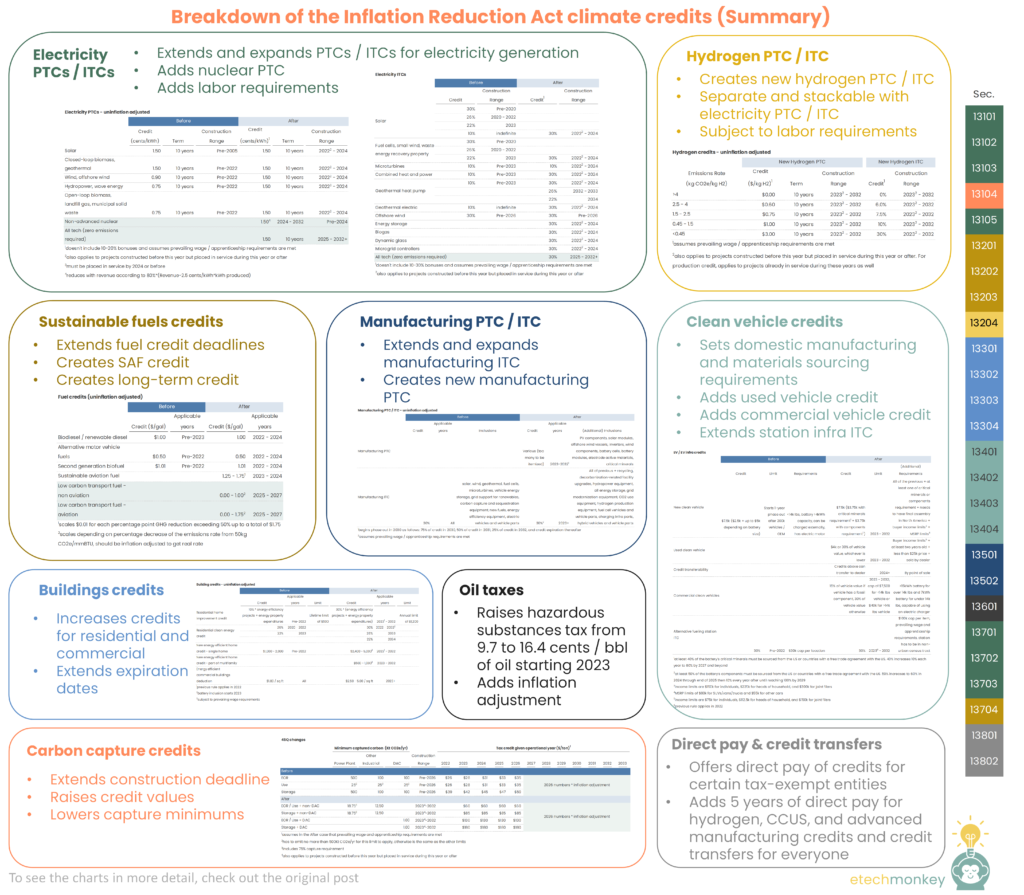

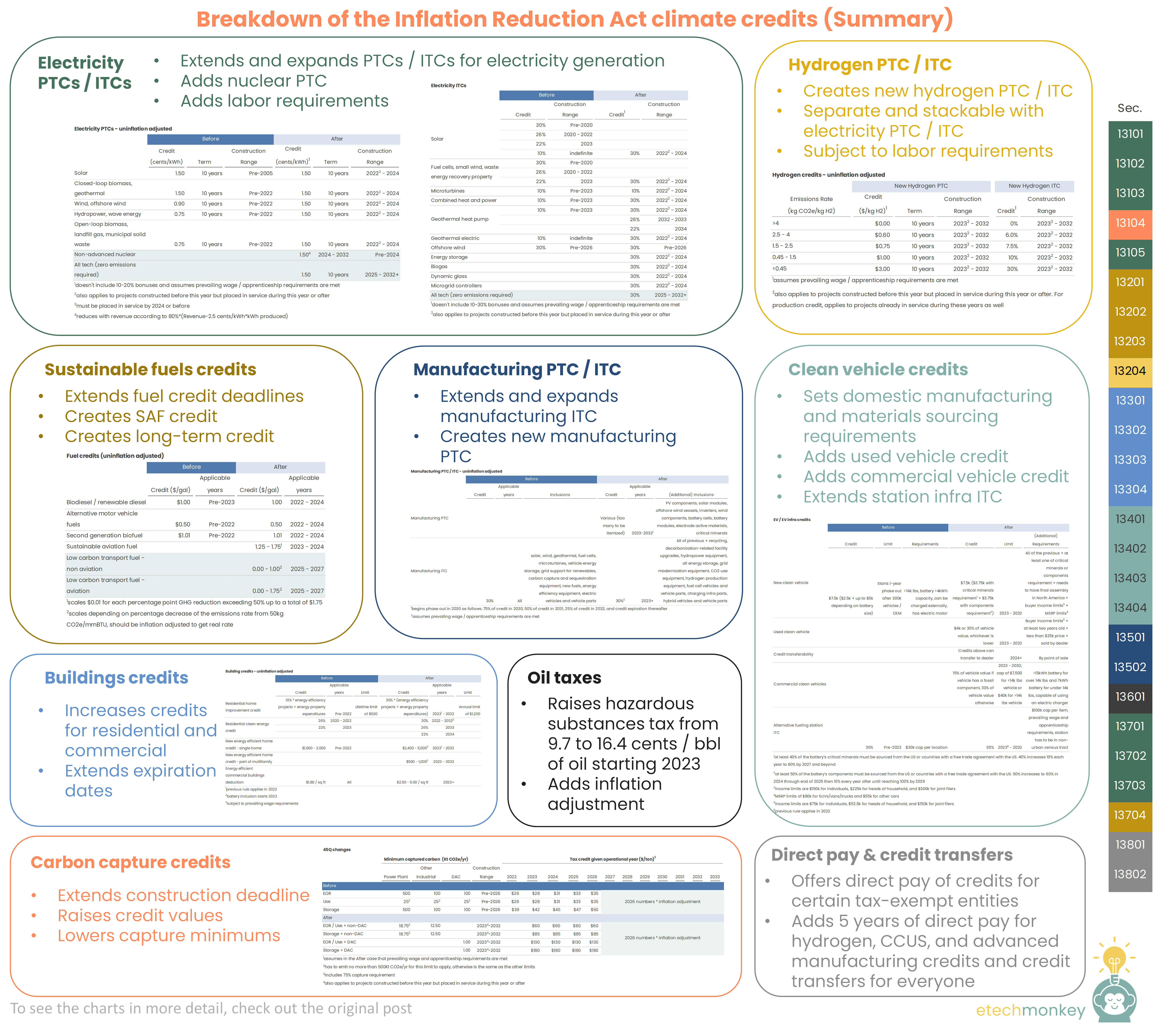

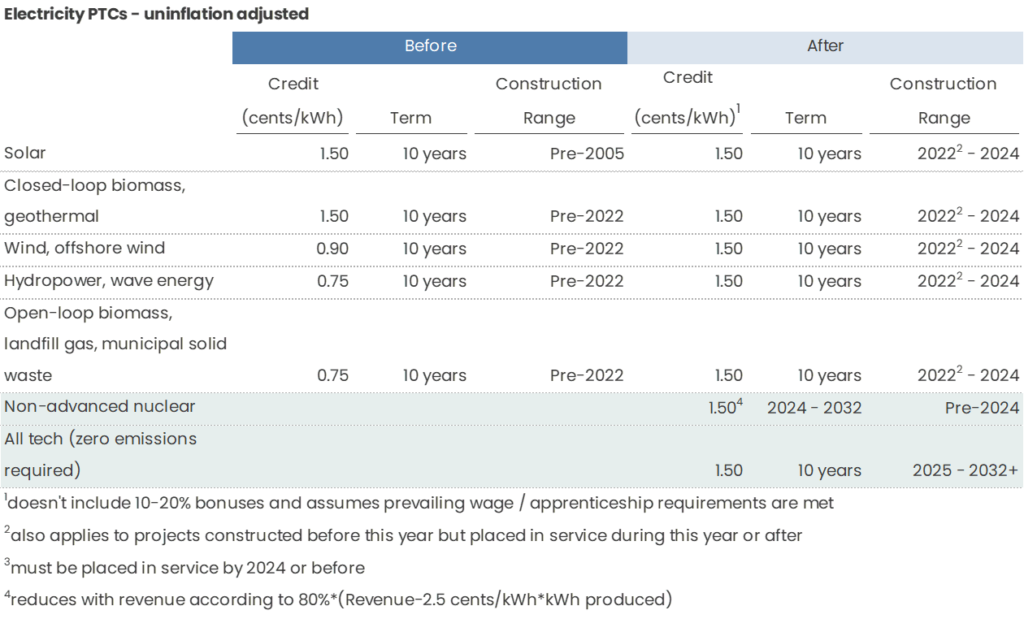

- Pre-2025 PTC / ITC extensions and expansions (Sec. 13101 - 13103)

- Extends PTC qualification deadline by 3 years to projects beginning construction before 2025 – this applies to wind, biomass, geothermal, hydropower, municipal solid waste, landfill gas, wave energy….and SOLAR, which had lost its PTC back in 2006

- PTC stays at 1.5 cents / kWh ONLY if the project meets prevailing wage and apprenticeship requirements. Otherwise, it is 0.3 cents / kWh

- There’s potential for two stackable 10% bonuses: 1) if the project’s products used in the facilities are produced domestically and 2) if the project is in an energy community (like a coal town)

- Extends ITC’s qualification deadline for the highest rate (solar and geothermal electric had permanent 10% rates past the deadline) by 1 year to construction before 2025 for solar, fuel cells, small wind, waste energy recovery, and microturbine projects. Geothermal pump projects get a 10 year extension to construction before 2035

- ITC reverts back to the pre-phase down rate of 30% to solar, fuel cells, small wind, and waste energy recovery projects meeting the deadline (if constructed after 2019 and placed in service before 2022, the rate is 26%), stays at 10% for microturbines, and upgrades to 30% for geothermal electric, combined heat and power, and geothermal heat pumps (with the last item starting a phase out rate schedule starting 2033). Energy storage, biogas, dynamic glass, and microgrid controllers get added to the 30% rate category. These rates are only available with prevailing wage and apprenticeship requirements and is otherwise divided by 5 (6% and 2%) if those requirements are not met

- Additional 10% bonuses for domestic content and energy communities

- Additional 10-20% bonus for wind and solar located in low income communities or housing

- Post-2025 PTC / ITC creation (Sec. 13701, 13702, 13704)

- Clean Electricity Production Credit - Starting in 2025, any zero-emissions facilities regardless of technology can qualify for a 1.5 cents / kWh PTC (assuming prevailing wage and apprenticeship requirements are met) for 10 years + 10% bonuses like above

- Clean Electricity Investment Credit – Starting in 2025, any zero-emissions facilities regardless of technology can qualify for a 30% ITC (assuming prevailing wage and apprenticeship requirements are met) for 10 years + 10% / 10-20% bonuses like above

- Both of these credits will start phasing out after at least 2032 or when the US electricity emissions reaches less than 25% of that in 2022

- Clean Fuel Production Credit – Starting in 2025, low carbon transportation fuel can qualify for a PTC of $1/gallon (assuming prevailing wage and apprenticeship requirements are met) * percentage decrease of the emissions rate from 50kg CO2e / mmBTU (e.g. 100% decrease, aka zero emissions fuel, would result in the full rate of $1/gallon)

- For sustainable aviation fuel, the rates are upped to $1.75 / gallon * percentage decrease of emissions rate from 50kg CO2e (again, assuming prevailing wage and apprenticeship requirement are met)

- This credit expires after 2027

- Nuclear credit (Sec. 13105)

- PTC for nuclear of 1.5 cents / kWh (assuming prevailing wage requirements are met) for nuclear facilities that are not advanced nuclear facilities (those already have a PTC) and are in service by 2024

- Credit is reduced once revenue exceeds a certain threshold – as calculated by 80% * (revenue - 2.5 cents / kWh * kWh produced)…basically if my math is right, credit goes to 0 once average electricity sales price hits 2.875 cents / kWh

- Credit doesn’t go into effect until 2024 and expires after 2032

- Hydrogen PTC / ITC (Sec. 13204)

- Creates a hydrogen PTC / ITC credits for projects beginning construction before 2033

- Potential PTC credit of up to $3 / kg if prevailing wage and apprenticeship requirements are met (otherwise divided by 5) and according to this emissions rate schedule:

- $0 / kg credit if emissions rate > 4kg CO2e / kg H2

- $0.60 / kg credit if emissions rate is between 2.5 - 4kg CO2e / kg H2

- $0.75 / kg credit if emissions rate is between 1.5 - 2.5kg CO2e / kg H2

- $1.00 / kg credit if emissions rate is between 0.45 – 1.5kg CO2e / kg H2

- $3.00 / kg credit if emissions rate is < 0.45kg CO2e / kg H2

- Creates a hydrogen ITC credit of up to 30% if prevailing wage and apprenticeship requirements are met (otherwise divided by 5)

- 0% if emissions rate > 4kg CO2e / kg H2

- 6% if emissions rate is between 2.5 - 4kg CO2e / kg H2

- 7.5% if emissions rate is between 1.5 - 2.5kg CO2e / kg H2

- 10% credit if emissions rate is between 0.45 – 1.5kg CO2e / kg H2

- 30% credit if emissions rate is < 0.45kg CO2e / kg H2

- Can’t double qualify for hydrogen and CCUS credits

- Can include retrofitted facilities

- Can double qualify for electricity PTC / ITC and hydrogen PTC / ITC

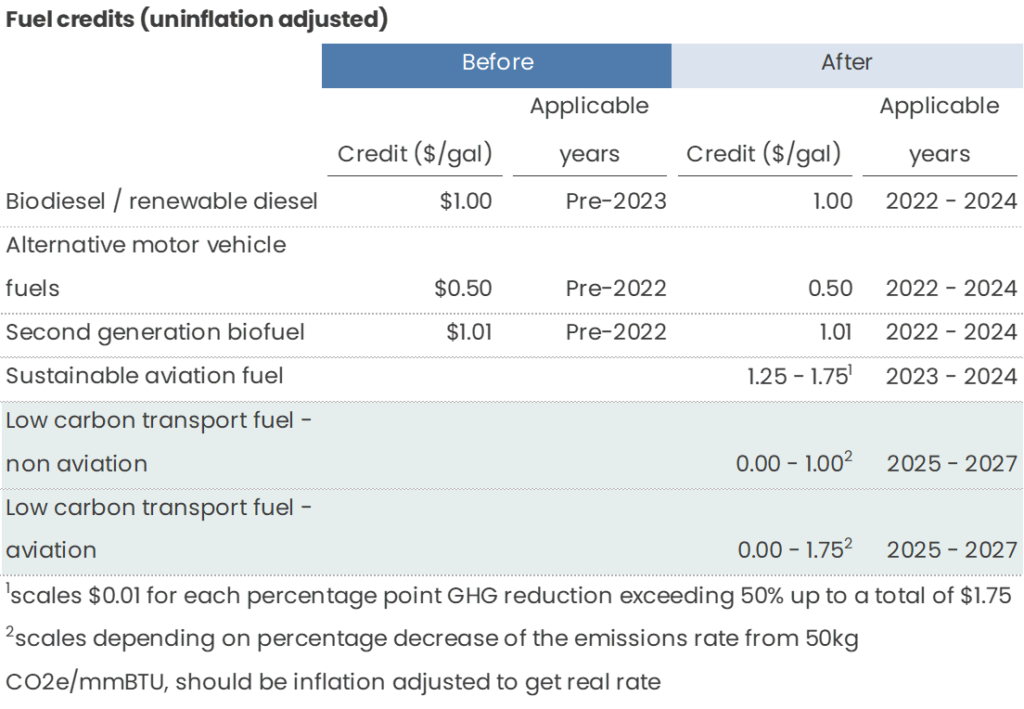

- Sustainable fuels credits (Sec. 13201 – 13203)

- Extends biodiesel and renewable diesel credits 2 years through to end of 2024

- Extends alternative motor vehicle fuel credits 3 years through to end of 2024 (had already expired end of last year)

- Extends second generation biofuel credit 3 years through to end of 2024 (had already expired end of last year)

- Creates a sustainable aviation fuel credit at a base $1.25 / gallon ($0.25 more than the biodiesel credit) + $0.01 for each percentage point GHG reduction exceeding 50% up to a total of $1.75 / gallon

- In order to qualify, the fuel must have a GHG reduction of at least 50%

- Credit doesn’t go into effect until 2023 and lasts for 2 years until the end of 2024

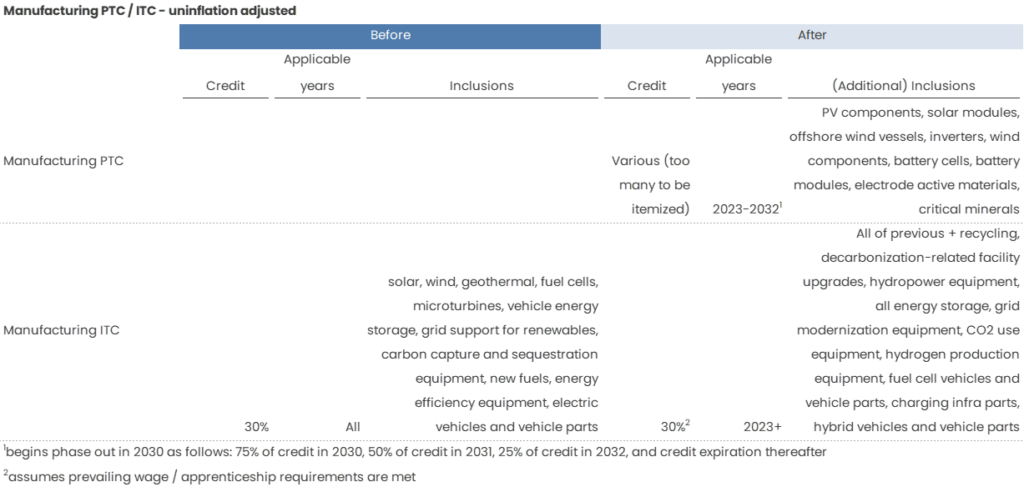

- Manufacturing PTC / ITC credits (Sec. 13501, 13502)

- Expands current 30% ITC for manufacturing of renewable / clean energy equipment to include recycling facilities, decarbonization-related facility upgrades (must reduce GHG by at least 20%), and facilities that manufacture hydropower equipment, energy storage equipment, grid modernization equipment, CO2 use equipment, hydrogen production equipment, fuel cell vehicles and vehicle parts, charging infra parts, hybrid vehicle parts

- Can’t be stacked with other ITCs, 45Q, or 45V (hydrogen) credits

- Starts in 2023

- Adds prevailing wage and apprenticeship requirements

- Adding an advanced manufacturing PTC through the end of 2032 (with 25% / year phase out starting in 2030)

- Examples of PTC rates: for PV solar cells, 4 cents / watt; for PV wafers, $12 / sq meter; for solar-grade polysilicon, $3 / kg; for polymeric backsheets, 40 cents / sq meter; for a solar module, 7 cents / watt; for offshore wind vessels, 10% of the price of the vessels….

- Covers other components like wind components, inverters, battery cells, battery modules, electrode active materials, and critical minerals

- Expands current 30% ITC for manufacturing of renewable / clean energy equipment to include recycling facilities, decarbonization-related facility upgrades (must reduce GHG by at least 20%), and facilities that manufacture hydropower equipment, energy storage equipment, grid modernization equipment, CO2 use equipment, hydrogen production equipment, fuel cell vehicles and vehicle parts, charging infra parts, hybrid vehicle parts

- Clean vehicle credits (Sec. 13401 – 13404)

- Eliminates the 200,000-vehicle manufacturer’s cap, allowing OEMs that have already reached that cap (Tesla, GM, Toyota) to qualify for the credits again

- For new cars, credit qualification requires that the car have final assembly in North America - this goes into effect immediately vs. 1/1/2023 like most of the other requirements

- For new cars, the credit is no longer scaled based on battery capacity but bifurcated into $3.75k if critical minerals requirement is satisfied and another $3.75k if the components requirements are satisfied. For PHEVs with small batteries, that’s up to a $5k credit increase than before

- To qualify, at least 40% of the battery’s critical minerals must be sourced from the US or countries with a free trade agreement with the US. 40% increases 10% each year to 80% by 2027 and beyond. After 2024, any percentage of critical minerals from a foreign entity of concern (namely China, Russia, Iran, North Korea) will disqualify a vehicle

- To qualify, at least 50% of the battery’s components must be manufactured or assembled in North America. 50% increases to 60% in 2024 through end of 2025 then 10% every year after until reaching 100% by 2029. After 2023, any percentage of components from a foreign entity of concern (namely China, Russia, Iran, North Korea) will disqualify a vehicle

- For new cars, buyers have an income limits and cars have MSRP limits to qualify for the credits

- Income limits are $150k for individuals, $225k for heads of household, and $300k for joint filers

- MSRP limits are $80k for SUVs, vans, and trucks and $55k for other cars

- Creates a one-time credit for the purchase of used EVs/PHEVs, which is the lesser of 30% of the value of the car or $4k

- Used cars have to be sold by a dealer, at least 2 years old, and priced at $25k or less

- Buyers have income limits of $75k for individuals, $112.5k for heads of household, and $150k for joint filers. They also are limited to 1 credit for every 3 years

- Buyers of both new and used cars can transfer the credits to the dealer, meaning that buyers can receive the discount upfront instead of having to file for the tax credit. This takes effect in 2024

- Both new and used car credits expire by end of 2032

- Creates a credit for commercial clean vehicles (defined as >15kWh battery for over 14k lbs and 7kWh battery for under 14k lbs, capable of using an electric charger) of 15% of the vehicle value if it has a fossil fuel component or 30% if it doesn’t

- Caps this credit at $7.5k for under 14k lbs (same as non-commercial) and $40k for over 14k lbs

- Expires by end of 2032

- Extends the clean fueling station ITC, which covers ethanol, natural gas / CNG / LNG, LPG, hydrogen, and biodiesel fueling or electric charging, 11 years (it had expired last year) to end of 2032

- Clean fueling station ITC stays at 30% but has a cap of $100k per item vs. $30k per location, additional prevailing wage and apprenticeship requirements, and now only applies to stations in non-urban areas

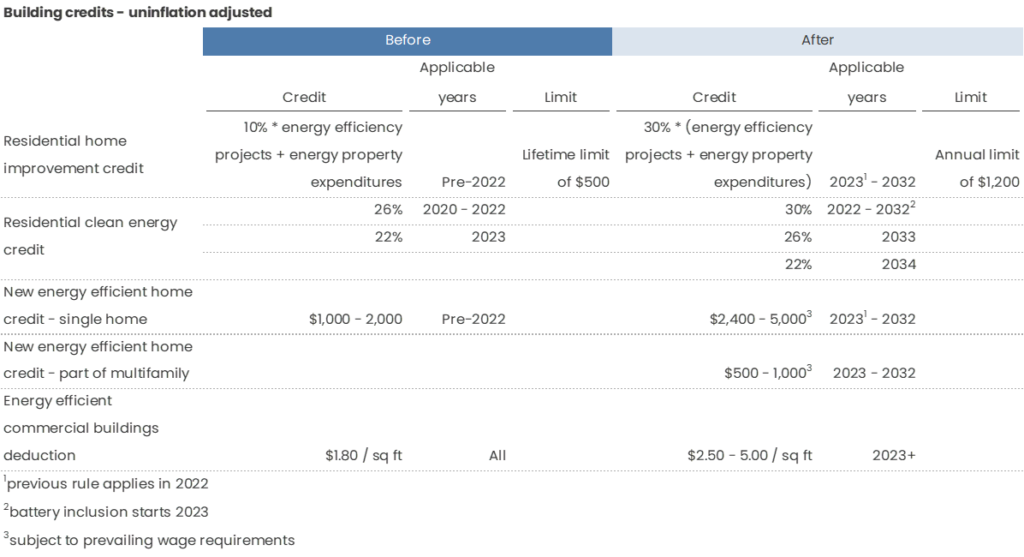

- Buildings credits (Sec. 13301 – 13304)

- Extends residential home improvement credits by 11 years (had expired end of last year) through end of 2032

- Modifies the residential home improvement credit to 30% of the total paid for energy efficiency improvements and energy property (like boilers or heat pumps) expenditures (as opposed to 10% of energy efficiency improvements and 100% of energy property expenditures) but raises credit limit to an ANNUAL limit of $1,200 from a LIFETIME limit of $500. Individual annual limitations are also included ($600 for energy property, $600 for windows, $500 for doors, $2,000 for heat pumps/boilers/stoves)

- Extends residential clean energy credit by 11 years from end of 2023 to end of 2034

- Changes residential clean energy credit from current 26% to tiered structure:

- 30% for projects placed in service before 2033

- 26% for projects placed in service starting 2033 and before 2034

- 22% for projects placed in service starting 2034 and before 2035

- Adds batteries to residential clean energy credit

- Extends the credits for energy efficient new homes by 11 years through end of 2032 and raises credits for homes eligible for certain Energy Star new homes programs by up to a couple thousand depending on situation (also has prevailing wage requirements)

- Effective 2023, raises the credits for energy efficiency improvements made to commercial buildings from $1.80 to $2.50 - $5.00 / sq ft (depending on how much energy costs are reduced) assuming prevailing wage and apprenticeship requirements are met

- Additional guidelines put in place for retrofits; partial credits also eliminated

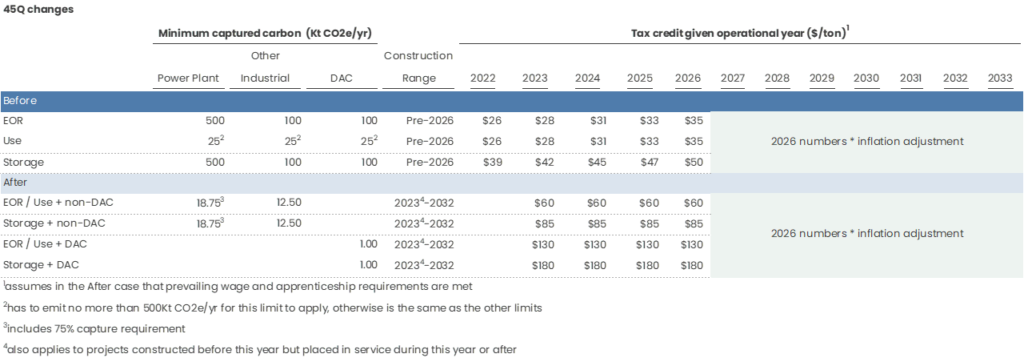

- 45Q extension / expansion (Sec. 13104)

- Extends deadline for qualification of projects 7 years to before 2033 instead of before 2026

- Expands qualification to facilities with lower capture requirements (for electricity generating facilities, 0.01875 Mt from 0.5 Mt / year; for DAC, 0.001 Mt from 0.1 Mt / year; for others, 0.0125 Mt from 0.1 Mt / year) but adds a 75% capture requirement for electricity generating facilities

- Increases credits for all years before 2027 to $60/ton for EOR/utilization and $85 (previously below $35 before 2026) and $85/ton for geologic storage (previously below $50 before 2026). For DAC facilities, the credits more than double to $130/ton and $180/ton, respectively. This is all provided that the prevailing wage and apprenticeship requirements are met (otherwise divide by 5).

- Direct pay & credit transfer options (Sec. 13801, 13802)

- Includes direct pay for PTCs / ITCs for tax-exempt entities, state or local governments, Indian Tribal Governments, or an Alaska Native Corporation

- Includes credit transfers for everyone

- Includes 5 years of direct pay for hydrogen, CCUS, and advanced manufacturing credits for everyone

- Superfund taxes (Sec. 13601)Raises hazardous substances superfund tax for barrel of oil to 16.4 cents / bbl from 9.7 cents / bbl and adds an inflation adjustment

- Starts in 2023

The full text: here

Other great summaries:

- CTVC’s detailed breakdown and their interview with Rhodium Group on the bill’s impact

- V&E’s longform summary of the bill

- Troutman Pepper’s comparison with BBB

- Nuclear credit charts from The Breakthrough Institute

- 45Q changes summary from Nixon Peabody

- Summary of the EV credits on Reddit