Looking at 10 different first commercial facilities & how they got funded

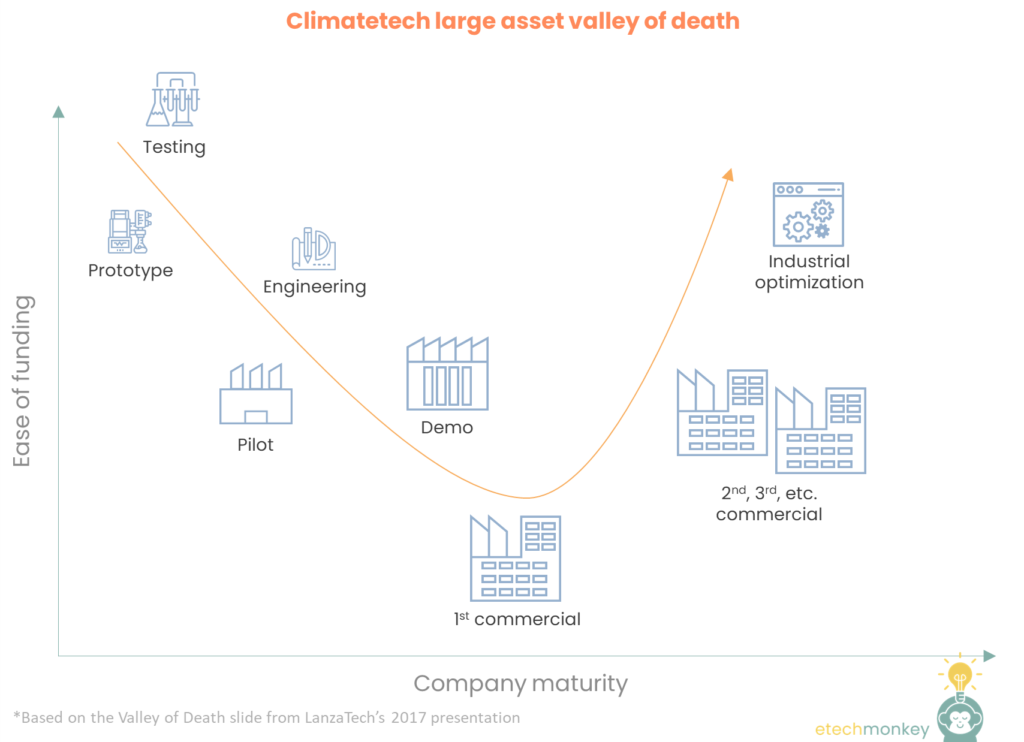

The scaling problem in hard asset climatetech is well-known and well-documented…valleys of death, unfit capital, project development challenges, etc. etc. Technologies that require some kind of plant, facility, or large chunky infrastructure to be built struggle the most with scaling. Here's how the ease of funding curve looks across a company's maturity (thanks, Lanzatech):

Initial funding for these technologies, if in small dollars, is relatively plentiful. For R&D and prototyping, startups can access grant funding and traditional VC capital (as well as capital from family offices, corporate VCs, incubators & accelerators, and other entities that surround the VC ecosystem).

After the technology has been prototyped and shown to work at lab scale, engineering work can take it to the next level and show that it can be used in the real world. Engineering work can mean expanding the team to include more engineers and/or contracting third parties like EPCs or labs to perform feasibility studies. Larger VC dollars can fund engineering work, though the pool of VCs that can write a later stage check for a pre-commercial tech is more limited than at the earlier stage.

Pilots and first demonstration assets / facilities are where the capital stacks start to detract from the normal VC ecosystem. Funding for pilots and demo facilities can edge into really late stage VC to growth equity levels of capital. Activities like permitting, buying construction materials, hiring a construction agency, adding plant personnel, etc. are expensive. Since the goal of this stage is to make sure the technology works and to prove out the engineering work, the plants are smaller, limited in connectivity to commercial outflows like roads or the grid or customers, and operate only for a fraction of the time. I’ve found that most of the “mature” hard tech climatetech companies with big plants to build are at this stage. This is especially true for the battery industry. Several of the names that have gone public via SPAC over the last few years – Solid Power, Quantumscape, FREYR, SES – are still undergoing pilots.

After the technology has been validated at smaller scale in the real world, both the technology and business model need to be proven together in building the first commercial version of the asset or facility. As we reach the trough of the growth curve, this is the hardest step to get funding for but the one that derisks the company the most. Building a commercial plant requires the capital of a pilot or demo facility scaled up to the point where the economics make sense + capital for additional personnel to run the plant or asset full time + capital for processes or certifications to enable the product to be sold commercially + capital for logistical infrastructure like trucks, roads, pipes, or other conveyances + capital for contingencies, unplanned downtime, regular maintenance….the list goes on. This step attracts investors looking for cash flow, which means that the technology has to be derisked, the financial model has to be airtight, and there has to be a high degree of certainty that revenue will occur.

Post-first commercial, companies can access the much larger pool of capital: private equity, infrastructure capital, and project finance equity and debt. These capital pools don’t have enough climatetech opportunities at their desired maturity levels and check sizes. A startup that reaches this stage usually has enough leverage to get pretty advantageous economics.

I wanted to better understand how a startup can get past that first commercial trough – are there any learnings that we can glean from past projects? To do this, I set out to collect examples of large commercial facilities (requiring >$50mm in capital) that have been funded climatetech.

Unfortunately, they were very difficult to find. My ideal dataset would be 30+…but I could only find 10.

Companies: CoolPlanet, Enerkem, LanzaTech, Monolith, Fulcrum Bioenergy, Lucid, Lanzajet, Arbor Renewable Gas, Carbon Engineering, Lithion

Some observations:

- Corporate involvement helps a lot. Half the projects on this list had some type of corporate sponsor or corporate partnership backing. For startups, working with a corporate on first commercial projects makes a lot of sense. Corporates often have already-permitted, already-functioning sites with access to logistical infrastructure, vendors, and/or customers. Corporates also likely have much lower cost of capital and may ask for less aggressive financial returns than a comparable institutional equity player, which translates to more favorable economics for the startup and other investors in the project. And finally, startups may be able to inherit best practices from a corporate partner – things like preventative maintenance, project management, safety regulations, and corporate governance – that can be difficult for a startup to learn on its own and prevent some painful lessons further down the road.

- Private and non-traditional equity can also play a major role in funding these projects. Most private equity firms don’t want to touch technology risk, which leaves a huge gap in equity offerings in the first commercial space. Tech-leaning private equity firms and non-traditional equity firms like family offices or sovereign wealth funds can play a big part in filling this gap.

I was a little surprised to see a complete lack of infrastructure equity on the list. I know there has been a big push as of late to redefine infrastructure and push capital deployment up the risk spectrum…but maybe we just haven’t seen these projects manifest publicly yet. - The new fuels space has enjoyed the most number of successfully funded large projects. 7 out of the 10 projects on this list produce some sort of fuel. Two reasons why:

1) The technologies that underlie these facilities are familiar and have precedence. Though the IP can be new, the reactions are most likely a revival of chemical processes that have been studied and understood for years (e.g. Monolith’s pyrolysis). As a result, these projects probably have found a better ecosystem of firms and consultants with the ability to diligence the technology for them.

2) Demand for the product exists today in large quantities. Most of these facilities aim to produce a drop-in fuel, which means that the market is easier to define and customers easier to sell to. Most other sectors of climatetech don’t have that luxury. - Other projects that didn’t make the list bypassed the first commercial hurdle by repurposing an older facility. You might look at the list and wonder why Lucid is the only EV manufacturer on it. That’s because other EV manufacturers have taken a different approach: purchasing existing factories. Tesla’s Fremont, CA factory, which it acquired in 2010 when it started mass-producing Model S’, used to be a GM/Toyota factory. Rivian’s first plant was also purchased – it used to be a Mitsubishi plant until it closed down 2 years before Rivian bought it. Hyzon purchased an old GM fuel cell facility in New York as its first plant.

This strategy hasn’t only been adopted by carmakers. Bolder Industries, a tire recycling startup, acquired an old tire recycling plant as its first plant.

Acquiring an existing facility can save money (especially if the asset is distressed) and, like working with a corporate, provide access to strategic benefits like logistical infrastructure, best practices, and even labor. But of course, this strategy only works for technologies that can share a lot of assets with an already-scaled operation, which limits its usefulness to areas like EVs or chemical plants.

TLDR; funding for large first commercial facilities has limited precedence. As climatetech scales to need a greater number of large first commercial facilities, companies should look to the fuels space for learnings, corporate and tech-forward private / non-traditional equity for sources of capital, and acquisition of existing facilities as an alternative strategy.