SPAC Mania

It’s been hard not to notice that SPACs have emerged as the new “It” vehicle for the capital markets. The last few Bloomberg headlines this past month speak enough in of themselves:

- “Why Blank Check Companies (SPACs) Are Filling Up Fast

- “What Are SPACs, the Hottest Stocks of 2020?”

- “TPG is Said to Plan ESG, Tech Blank-Check IPOs Amid SPAC Boom”

- “Cowen’s Solomon Says SPACs are the ‘Flavor of the Month’”

- “Ranadive Calls SPACs ‘Greatest Wealth Creation Opportunity in History’”

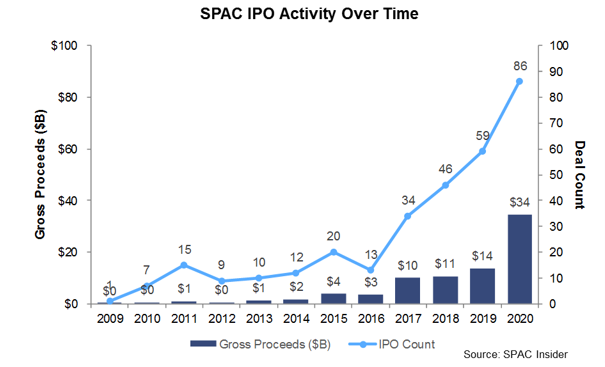

More than 80 SPACs have IPO-ed in 2020, a ~46% increase over 2019. ~57% of these have occurred just in the last two months. There’s clearly a hot market for these nontraditional investment vehicles – the question is: is this a temporary surge or are SPACs here to stay?

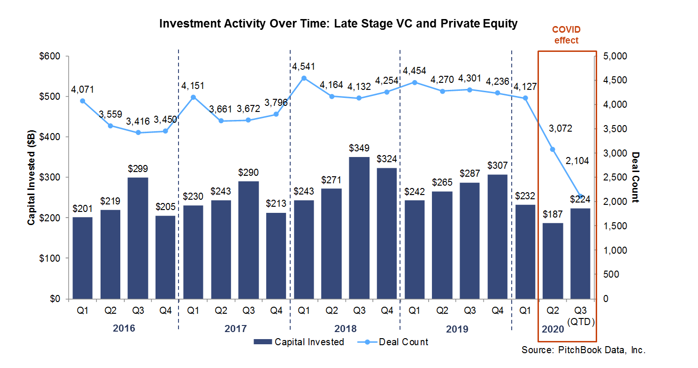

Much of the recent SPAC activity can be attributed to the widened gap in capital deployment that has formed between the public and private markets. COVID had the curious effect of both slowing down private capital and accelerating public capital, all in a very short amount of time. So while the S&P and Nasdaq continue to near record highs, late stage VC and PE buyout activity have slowed to near record lows. Figure 1 shows quarterly late stage VC and PE buyout activity and the clear disruption in the normal cycles of deal activity.

But it’s hard to isolate this as the sole cause for why SPACs are suddenly all the rage. While 2020 has clearly been a standout year for the SPAC world, SPACs have enjoyed a steady rise in the markets since about five years ago, with various ups and downs in the years before then. Figure 2 shows historical SPAC IPO activity over time.

SPACs have mainly served a niche market: taking companies public that would normally not be candidates for traditional IPOs. These include companies with odd growth cycles, companies that operate in areas where financing is hard to access, and companies with non-traditional assets. One reason for the rise in SPACs has been a rise in number of companies that fit these profiles. Because the time to exit has gotten longer, there are more late stage start up businesses than before, especially ones that would normally seek funding from private equity or venture capital and for one reason or another have limited access to that pool of capital.

Another reason has been the general rise in popularity of private investors, whose successes and reputation in the private markets have started to transfer to the public markets. We have seen the growing eagerness to participate in alternative asset classes via public vehicles manifest itself already, via alternative asset mutual funds, public private equity investors, REITS, MLPs, etc. SPACs seem to be the next evolution of this interest. For public investors, SPACs are a way to ride the private equity train while paying a discounted fare: being able to participate in private equity-like returns while maintaining the liquidity of being public.

But I think one final, perhaps less discussed reason, has been the slow realization over time that SPACs are becoming a more preferred vehicle to go public, especially ahead of market uncertainty. With a SPAC, a company can go public quicker (bypassing an arduous registration process), have more certainty around valuation, and have more visibility around its future investor base. The cons to going the SPAC route include significant dilution and less capital raised vs. a traditional IPO. But the popular practice of underpricing IPOs has lessened the dilution gap and the ability for SPACs to raise PIPE financing has lessened the new capital gap. The reasons for SPAC-ing begin to far outnumber the reasons for not.

So I think the question “Are SPACs here to stay?” can be answered with a resounding yes. And as energy tech investors, this is a very good thing. It's well known the difficulty with transacting hard asset technology companies with traditional investment vehicles. As SPACs grow in number and popularity, these very non-traditional investment vehicles can be the key to accelerating energy transition.