The different flavors of corporate sustainability software

It’s been interesting to observe the vast array of digital technologies available to help build out a company’s sustainability strategy. What initially started as a space largely dominated by consulting firms and ratings agencies (e.g. Bloomberg, Sustainalytics, and MSCI) has now grown to be a thriving software-driven ecosystem.

VCs are enamored with funding corporate sustainability software (or climate-driven software of any kind). Over $570mm have been invested in climate reporting software in the first half of 2021, which, while only ~1% of all climatetech investment in this period, was spread over a larger number of early stage deals. A similar report by CTVC highlights that Carbon, the bucket of companies that includes carbon tracking and accounting software, experienced significantly more growth Y-o-Y in number of companies funded and new unique investors than other sectors. At face value, this is one of the few subsectors in climatetech that VC is well primed for: it’s easily scalable, capital light, has a huge market size (any company that cares about sustainability, which is everyone these days), and directly benefits from the large number of corporate dollars going into transition.

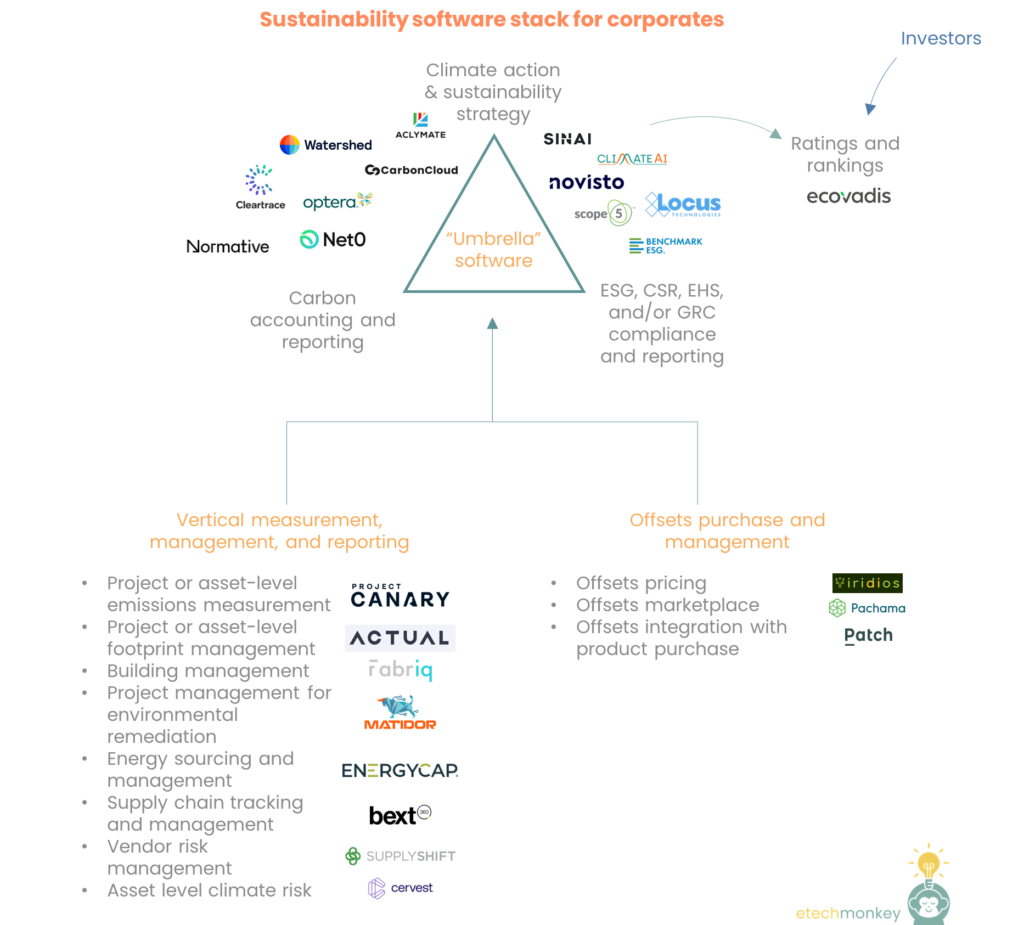

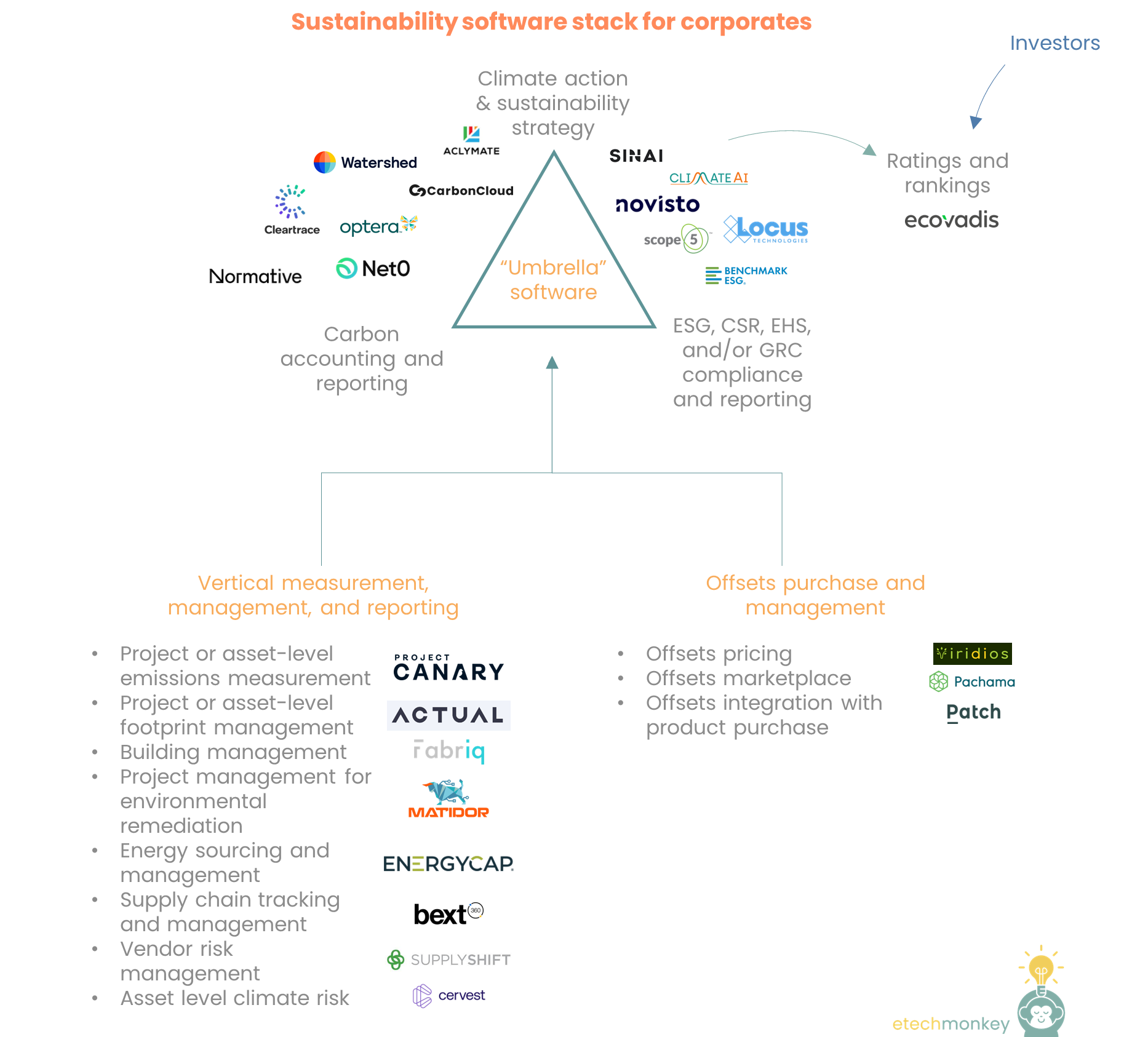

There are several different flavors of corporate sustainability software:

(Note that the companies mentioned are not vetted or sorted. This is just a list I compiled of advertised software applications from various companies)

- “Umbrella” systems – these are software and/or SaaS tools that work to summarize & aggregate information across an organization for some purpose. The information is always inclusive of emissions and carbon footprint but can also include energy management, community actions, and other relevant impact information. The “umbrella” software in sustainability seems to be divided into three main categories:

- Carbon accounting and reporting, which is tackling the difficult problem of aggregating and calculating a company’s carbon footprint from disparate (and often times non-digitized or automated) data sources

- ESG, CSR, EHS, and/or GRC compliance and reporting, which helps a company aggregate relevant data for outside stakeholders and agencies

- Climate action and sustainability strategy, which is how a company plans to improve its sustainability picture based on targets it has set on its data

Most of the “umbrella” software companies seem to incorporate elements of all three, though some have more of an emphasis on one pillar than the other (e.g. Locus or Benchmark ESG which is more EHS and ESG software vs. Normative or Net0 which are focused on the carbon accounting vs. ClimateAI or Aclymate which emphasize climate action). Some “umbrella” software companies focus on specific end-markets, such as SINAI for industrial heavy emitters or CarbonCloud for the food industry

- Carbon accounting and reporting, which is tackling the difficult problem of aggregating and calculating a company’s carbon footprint from disparate (and often times non-digitized or automated) data sources

- Vertical measurement and reporting – these are the individual building blocks that feed into an “umbrella” software management tool. These software tools track and manage a company’s operational and emissions-producing activity for a single “vertical,” which can be an asset (or set of assets) or whole company division. The challenges with this subvertical are data collection frequency, integration with physical devices onsite, and integration with other software programs. Vertical software can include companies like Project Canary, which works to measure GHG emissions of assets and groups of assets, ActualHQ, which streamlines scenario planning for decarbonization at the asset level, Fabriq, which focuses on building management and decarbonization, Matidor, which serves the environmental remediation workflows, EnergyCap, which manages energy sourcing and utility bills for companies, Bext360, which uses blockchain for supply chain traceability, SupplyShift, which identifies sustainability-related vendor risks, and Cervest, which calculates climate risk at the asset level

- Offsets purchases and management – or the part of the carbon economy that directly faces corporates. With how illiquid and fragmented the offsets market is, most companies need a third-party provider to help manage and purchase offsets. Some startups like Viridios help companies value and price offsets while others like Pachama actually create marketplaces for the offsets. Other companies like Patch have offered a way for consumer-facing companies to actually integrate carbon offsetting into their checkout process. All of this data gets incorporated into the “umbrella” systems

- Ratings and rankings – these are the companies that take publicly reported sustainability or ESG data (which are derived from what’s put out by companies with the “umbrella” systems) and compile them into rankings or ratings. Most agencies create these datasets for investors, though some of them allow input from the companies themselves. There are also not that many startups in this area anymore as most of the major ones, like Sustainalytics or Vigeo Elris, have been acquired by the larger data firms. Ecovadis, which is PE-backed, is one of the few exceptions I’ve found. My first thought was that there should be more emerging startups that offer third party rankings…but this report mentions 600+ ESG ratings and rankings exist already

A few observations:

- This space is crowded. There are a ton of “umbrella” systems in particular, which may stem from the fact that there seems to be a plethora of legacy software used for EHS that are now expanding to include ESG and sustainability. It’s not clear from a surface level scan of these companies how much they differentiate from each other or what the competing factors are (speed of implementation? Integration with other software? UI?). Perhaps the ecosystem isn’t yet mature enough for that to drive marketability

- There will likely be more sector specialization. Sustainability for heavy industry is very different from sustainability for consumer/retail which is very different from sustainability for food/ag. Each industry will need to adopt more and more specific strategies after taking care of the low hanging fruit (like decarbonizing company vehicles or sourcing more renewable power). Software companies will likely need more industry insiders to implement and sell solutions. We’ve seen the same thing happen with AI, which initially was offered to many industries by horizontal tech specialists and which has since evolved to require domain specificity

- Mass consolidation is on the horizon for “umbrella” systems. The market currently has many different players that are competing for “first in the door” implementations in a largely finite corporate universe. There’s a good chance that many of these initial implementations will have a substantial incumbency advantage as the cost of switching to a new software system outweighs the incremental benefit of switching to a new system (unless there’s a big advantage like much lower price or sector specialization as discussed above). Thus, the only way in the future for whoever is left from today’s initial scramble to expand will be to acquire into new customers. We should see this space as ripe for acquisitions, mergers, and rollups near term

Some other resources for those that want to look further:

- Base10’s coverage of their environmental vertical

- CTVC’s articles on corporate carbon accounting and carbon economy

- WorldFavor’s landscape on CO2 emissions tracking software

- Pietro at Stride.VC’s landscape of climatetech software startups