The impact of West Virginia vs. EPA: not great but not terrible

Last Thursday’s SCOTUS decision on West Virginia vs. EPA made waves across the climatetech community in denying the EPA’s authority to set power plant emissions targets using generation shifting and market mechanisms like cap-and-trade. It set a restrictive precedence on the EPA’s ability to accelerate energy transition and removes one of the key regulatory levers that the US has in its emission reduction battle.

I wanted to better understand what the impact of this ruling can be on absolute emissions numbers, power sector participants, and general ecosystem dynamics.

First, to provide some context on the case…West Virginia vs. EPA emerged from West Virginia (and other states) suing the EPA over the Clean Power Plan (CPP). The CPP was issued in 2015 by the Obama administration and was never actually put into action. It was replaced in 2017 by the Trump administration’s Affordable Clean Energy Rule (ACE), which eventually also died. So none of the policies being argued about in this case are actually active in any sort of way.

Nonetheless, the case resurfaced on the Supreme Court docket in October 2021 and SCOTUS decided to grant it for review.

The language under consideration is in Section 111(d) of the Clean Air Act (CAA), the main air quality law for the US and one that gives the EPA administration rights over emissions control. In Section 111(d), the EPA is granted authority to establish a “standard of performance” for emissions sources — aka an emissions limit — using “the degree of emission limitation achievable through the application of the best system of emission reduction.” In non-legalese, that means that the EPA can set emissions limits based on systems they believe an operator can achievably put in place to reduce emissions to that limit.

In the CPP, the “systems” they argue can span three “building blocks”: 1) internal facility improvements like making plants more efficient by upgrading equipment, 2) shifting generation from coal-fired units to natural gas-fired units, and 3) shifting generation from natural gas-fired units to renewable generation sources or nuclear. CPP also includes the option for states to establish a multi-state credits trading system in order to achieve those emissions goals.

The ultimate ruling of the court claimed that building blocks 2 and 3 + the potential cap-and-trade system were not clearly systems covered by “best system of emission reduction” in the CAA and that, because of the ambiguity and significance of future generation mix, the major questions doctrine applies. Under the major questions doctrine, the regulatory agency must be given clear authorization by Congress to decide on major issues. Since the EPA has not been given clear authority by Congress, it has no authority to put systems in place to shift generation sources.

My first reaction to this was that the case presents a troubling degree of triviality coupled with just straight misinformation. The court’s argument over the interpretation of “systems of emissions reduction” was anchored by its repeated statement that the EPA had never implemented similar system-wide mechanisms previously. For example:

- “The first building block was ‘heat rate improvements’ at coal-fired plants—essentially practices such plants could undertake to burn coal more cleanly…This sort of source-specific, efficiency improving measure was similar in kind to those that EPA had previously identified as the BSER in other Section 111 rules. Building blocks two and three were quite different…”

- “Prior to 2015, EPA had always set Section 111 emissions limits based on the application of measures that would reduce pollution by causing the regulated source to operate more cleanly… never by looking to a ‘system’ that would reduce pollution simply by ‘shifting’ polluting activity ‘from dirtier to cleaner sources.’”

- “Finally, the Court has no occasion to decide whether the statutory phrase ‘system of emission reduction’ refers exclusively to measures that improve the pollution performance of individual sources, such that all other actions are ineligible to qualify as the BSER. It is pertinent to the Court’s analysis that EPA has acted consistent with such a limitation for four decades.”

But there is precedence for EPA establishing external mechanisms as “systems of emissions reduction.” The EPA has several existing emissions trading programs. The one it offered up in response to the court’s criticism is the 2005 Mercury Rule, which the court said was not applicable because “in that regulation, EPA set the emissions limit—the ‘cap’—based on the use of ‘technologies [that could be] installed and operational on a nationwide basis’ in the relevant timeframe.” The court continues to argue, “By contrast, and by design, there are no particular controls a coal plant operator can install and operate to attain the emissions limits established by the Clean Power Plan.”

This seems to be at best, misinformation, and at worst, misdirection. The CPP did incentivize operators to switch emissions sources, but the limits provided were very reasonable. For new coal plants, the limit of 1,400 lbs CO2 / MWh assumed an efficient steam unit with partial carbon capture. For existing coal plants, the CPP did mandate that some level of emissions reduction had to occur but acknowledged that the limits would depend on each individual units’ potential performance vs. the sweeping limit placed on new plants. That means that it was likely that for an existing coal-fired plant, the limit would have been much higher. And even if we do take the 1,400 lbs CO2 / MWh as the limit for existing plants, there is research indicating that equipment upgrades like CCS retrofits or ultra-supercritical steam generators can be cost competitive with generation shifting.

The emissions impact is minimal to modest. As said before, the CPP, or even its less restrictive ACE counterpart, was never put in place, so there is no direct policy impact from SCOTUS’ ruling.

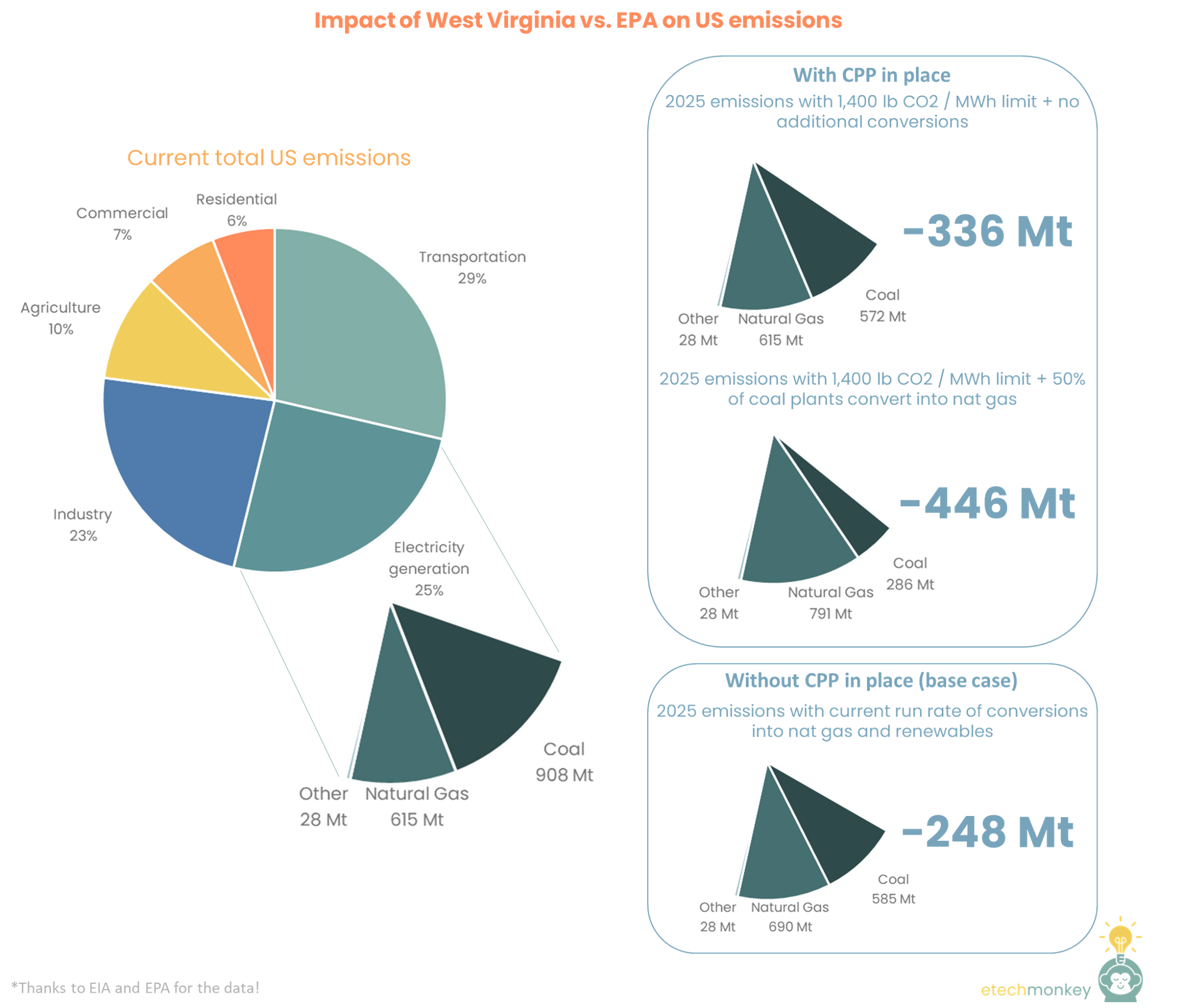

It’s also arguable what kind of impact CPP would have had in the first place. Despite not implementing CPP, the US has already reached the CPP’s 2030 target of reducing power sector emissions 32% from 2005 levels (32% of 2,411 Mt CO2 energy emissions in 2005 is 1,640 Mt…we’re at 1,551 Mt as of 2021). Nearly all of this can be attributed to coal retirements / conversions to NGCC and switching to renewables. Since 2007 (the peak in the last two decades), the US is down ~1,118 GWh of coal, offset by increases in nat gas, +679 GWh, and wind/solar, +459 GWh. Out of the corresponding 871 Mt CO2 decrease in power sector emissions, ~44% is due to using more nat gas and the remaining 56% from increase in renewables.

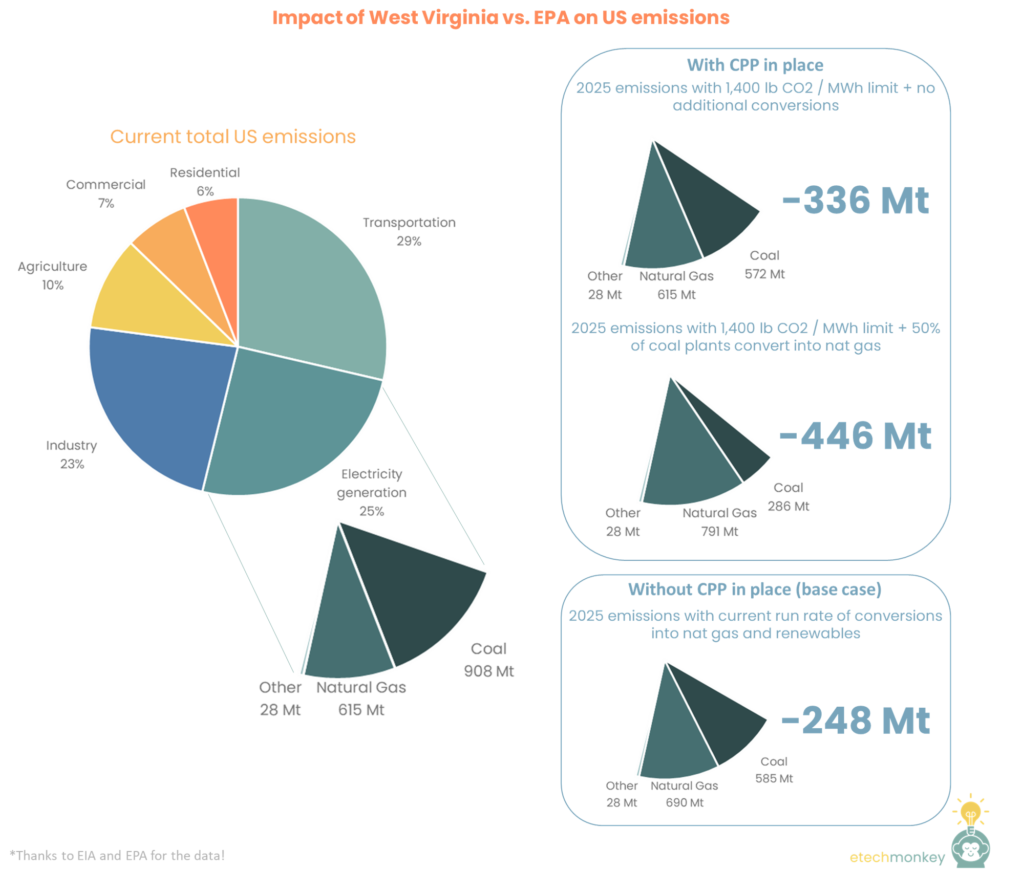

At the current rate of coal-to-nat gas and renewables switching (assumes linear rate of coal retirements and 60/40 switching to nat gas vs. switching to renewables), the US can get power emissions down 248 Mt by 2025 and 681 Mt by 2032, nearly completely switching from coal by the end of the decade. That’s a ~60% decrease from 2005 emissions levels, much more than the 52% that Biden recently announced as a goal for overall US emissions for 2030.

No doubt that the CPP, if implemented now, would accelerate a transition. If we assume that all existing coal plants have an emissions limit of 1,400 lbs CO2 / MWh (an aggressive assumption for the reasons outlined in the last section) vs. the current average of 2,223 lbs CO2 / MWh, emissions from coal would go down 336 Mt in 2021. Additionally, if, as a result of CPP, half of the coal plants in the US decide to switch to nat gas (which has an emissions intensity of 859 lbs CO2 / MWh) instead of retrofit, that impact number goes up to 446 Mt. It takes 3-5 years from announcement to completion for a coal conversion project, so we can take these numbers to be comparable to the 2025 emissions numbers mentioned in the previous base case. Even with a mass wave of retirements that an emissions limit would incentivize, CPP would only reduce 2025 emissions by another 198 Mt and accelerate the complete coal retirement timeline by perhaps 2-4 years.

Bottom line is that even without policy-driven generation switching, the shift is already happening, and adding policy can provide an incremental but modest boost to switching.

Others in the ecosystem will need to step up to the plate. Although there is already a healthy amount of generation switching, what this ruling does is take away EPA’s ability to set up an even more accelerated schedule of switching until Congress gives it explicit authority to do so. This will put pressure on Congress to be more active in putting out legislation that makes this authority clear or specifying the regulations themselves.

The increased difficulty of the EPA to create carbon pricing or additional cap-and-trade programs might also be problematic. Cap-and-trade in the US has had a tumultuous history, with several failed attempts in Congress over the years to establish a program. It’s unlikely if EPA is not given the authority that Congress will be able to pass such a measure in time for it to make a meaningful impact.

There are luckily other ways for the ecosystem to regulate itself. One less tool in the EPA toolbox means one more that needs to come from elsewhere. The three market participants I see that will have a larger responsibility as a result of West Virginia vs. EPA:

- Capital providers – most of the incentives for current power producers to switch are the ESG and transition requirements to access capital (especially in competition with peers). Current coal retirements are being led by utilities/power producers with pressure from their investors to meet net zero goals. As the EPA loses some of its leverage, the onus will continue to be on capital providers to establish financial consequences for not meeting industry-wide environmental benchmarks.

- Startups working on the carbon economy – An organically built carbon pricing market can develop to serve as a proxy for a regulatory one. Many startups are already working to build tools and exchanges for creating transparent carbon pricing and a more liquid carbon market (e.g. Nori, Carbonfuture, Pachama, Puro, Sylvera, Viridios, etc.). Without the likelihood of a federal carbon pricing program, startups will have to keep pushing for the voluntary markets to fill the gap.

- Other regulators – the SEC, state regulators, and Congress can all play a bigger part in attacking the regulatory issue from other angles. The SEC is already putting in requirements for climate reporting, though this only takes care of publicly traded companies. State regulators have the ability to put in state-wide cap-and-trade programs, like California has successfully done, or work with regulators in other states, as in the case of the Regional Greenhouse Gas Initiative. Congress, as mentioned before, has the greatest leverage in its ability to confer authority at the federal level.

All in all, though West Virginia vs. EPA is pointed to as one of the most significant environmental rulings in many years, I feel hopeful that the actual impacts from the decision are minimal. Emissions in the power sector are already organically decreasing because of non-regulatory market forces. Active environmental leadership will still come from the companies that have already made it a priority. And we have a good number of non-regulatory levers that we can pull to incentivize industry-wide movement. Call me naïve but I have faith that structures we’ve built outside of regulation can continue to keep us afloat.